Two Wheeler Loan Interest Rates & Fees.

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

What is the Two Wheeler Loan Interest Rate?

Hero FinCorp offers low-interest Two-Wheeler Loans to make buying a bike easy. Our simple process, competitive fees, and custom loan options fit your needs. No hidden costs—just a quick, hassle-free loan to help you get your dream bike!

Are You Eligible?

Let's Find Out.

Bike loans come in two types: income-based and non-income-based. Income-based loans have lower interest rates and higher loan amounts if you qualify. Non-income-based loans help you get a bike without proof of income.

Hero FinCorp Two-wheeler Loan Interest Rate.

A two-wheeler is not just a vehicle; it is the freedom of mobility. At Hero FinCorp, our affordable Two-Wheeler Loans enable you to purchase your perfect bike without having to dig into your savings. Our Two-Wheeler Loan interest rates start at 14% per annum. Surprised? Don’t be. Read on to know more.

Interest

Rates

Starting from 14% per annum (Reducing Balance Interest Rate)

Processing

Fee

Up to 5% of Loan Amount (Reducing Balance Interest Rate)

Prepayment

Charges

5% on Principal Outstanding (Interest applies for foreclosures within 6 months of disbursement) (Reducing Balance Interest Rate)

Two Wheeler Loan Miscellaneous Charges.

When considering a Two-Wheeler Loan, it's always a good idea to carefully read the loan agreement. At Hero FinCorp, we strive to keep our miscellaneous charges minimal and transparent, ensuring that you have a hassle-free loan experience. Learn what are these charges -

PDC

Charges

PDC stands for Post Dated Cheque; lenders may ask for a certain number of PDCs. For this, certain charges or fees apply for managing and processing these cheques.

Loan

Processing Charges

These charges are usually a percentage of the loan amount and can vary based on the loan amount.

Bounce

Charges

Bounce charges are the fees that apply in case a cheque or payment bounces due to insufficient funds in the borrower's account. These charges can vary depending on the amount of the bounced payment.

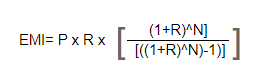

How to Calculate the Interest Rate for Two-wheeler Loan?

You can either apply a mathematical formula for Bike Loan Interest Rate Calculation or calculate your Two-Wheeler Loan interest rate using our Two-Wheeler Loan EMI calculator. The mathematical formula for bike loan interest calculation is:

The mathematical formula for bike loan interest calculation is.

Where,

E is the EMI

P is the Principal Loan Amount

R is the Rate of Interest

N is the Loan Tenure in months

Factors Affecting Two-wheeler Loan Rate of Interest .

Before you apply for a bike loan, learn about the factors that influence your bike loan interest rate.

Credit

History

A strong credit score helps get lower interest rates.

Income

Higher income may reduce the loan interest rate.

Age

Younger earners often get better interest rates.

Bike

Model

High resale value bikes may qualify for lower rates.

Employment

Interest rates vary for salaried and self-employed applicants.

Lender

Relationship

Existing customers with good payment history get better rates.

How to Get Lowest Two-Wheeler Loan Interest Rate in India?

Here are some tips to finance a two-wheeler with lowest interest rate:

Improve your Credit Report

Pay off missed EMIs to boost credit history.

Reduce Debt

Lower your debt-to-income ratio for better loan rates.

Increase

Down-payment

A higher down payment can lower interest rates.

Existing

Lender

Strong lender relationships may get you better rates.

Negotiation

A strong profile allows you to bargain for lower rates.

Things to Consider Other Than Two-wheeler Loan Interest Rate .

While the interest rate plays a crucial role in choosing a bike finance, there are more things to keep in mind before signing the dotted line.

Processing

Fee

A one-time, non-refundable cost for loan processing.

Eligibility

Criteria

Check the loan eligibility criteria to qualify for the lowest rate.

Prepayment

Terms

Review foreclosure rules and prepayment charges.

Disbursal

Time

Choose a lender with quick loan processing.

Special

Offers

Look for festive discounts and exclusive deals.

What do people think about Hero FinCorp.

Sumesh V S - Cherai, Ernakulam, Kerala

Aditi Jain - Hyderabad

Manish Singh - Udaipur

The latest news.

FAQs.

Zero down payment options are available to our customers, subject to terms and conditions.

Meet the eligibility criteria for lower interest rate options and we’ll offer you the loan amount to finance your bike at an affordable price.

Processing fees vary, so contact us for details. We’ll decide your processing charge based on your approved loan limit.

Foreclosure charges apply, and for specifics read the loan agreement we sent to you.

No, 0% interest on Two-Wheeler Loans is not typically available.