Securing Your Ride, Light on Your Pocket.

Your Bike, Your Coverage, Your Peace of Mind

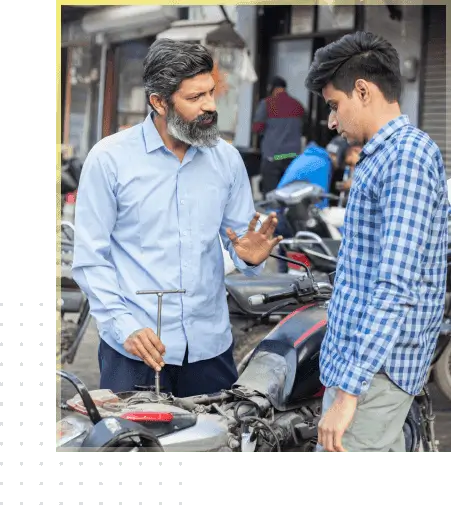

What is Bike Insurance?

Bike insurance, also termed 2 wheeler insurance, is an insurance policy that provides coverage against different damages to your motorcycle or scooter in case of an accident, fire, disaster, or theft.

Moreover, it covers third-party liabilities in case your two-wheeler causes damage to another person's life, health, property, or vehicle.

Why is Two Wheeler Insurance Mandatory?

According to the Motor Vehicle Act of 1988, third-party insurance bike insurance is mandatory in India. The government has made insurance mandatory to protect bike owners during road accidents financially.

Apart from the regulatory compulsion, insurance also provides a hedge against severe consequences in case of a mishap.

Reasons and Benefits of Buying Bike Insurance

Let’s look at the various reasons and benefits of buying an insurance policy for a bike:

- Financial Benefits: Mishaps are unpredictable, and the related costs can drain all your savings. Bike insurance provides financial benefits when an accident, damage, or theft occurs on your bike. It also offers financial coverage when your bike causes injury to another person or damages their vehicle or property.

- Personal Accident Cover: If you purchase personal accident cover with your insurance policy, your family gets financial support in the event of your death or injury.

- No Claim Bonus: If you do not raise a claim for a policy period, you get a No Claim Bonus on your next policy renewal. Even if you buy a new bike, you can transfer this bonus to its insurance policy. At Hero FinCorp, you can get a discount of 20% if there is no claim made during the preceding year. The discounts increase up to 25% for two years, 35% for three years, 45% for four years, and 50% for five years of no claim made or pending.

- Cashless Repairs: If your bike needs a repair, the insurance plan can cover its cost without paying anything upfront.

Types of Two Wheeler Insurance Policies.

Mainly, there are three types of two-wheeler insurance plans in India, and Hero FinCorp offers them all.

Third-Party

Bike Insurance Plan

Third Party Bike Insurance Plan is a mandatory insurance plan in India providing two-wheeler insurance coverage against third-party liabilities. It includes coverage if your bike causes damage to a third party but does not cover your own damage.

Comprehensive

Bike Insurance Plan

A comprehensive insurance plan covers both third-party liabilities and damages caused to your own motorcycle in case of an accident, fire, natural disaster, theft, or man-made calamity like riots.

Standalone

Own Damage Cover

Also called OD insurance, it covers damages to your own two-wheeler.

Are You Eligible?

Let's Find Out.

Are You Eligible?

Let's Find Out.

Below the list of events that the Hero FinCorp bike insurance covers

Here is a list of events that the Hero FinCorp bike insurance covers:

- Third-party liabilities or losses: Damage to a third-party person or their vehicle or property

- Accidental damages: Damage caused to your vehicle during an accident

- Fire: Damage to your bike due to self-ignition, lightning, or fire explosion

- Natural disasters: Damage to your motorcycle due to a flood, earthquake, cyclone, etc.

- Man-made disasters: Damage to your bike due to a riot, terrorist activity, protest, etc.

- Total Loss or theft: Financial loss due to your bike’s total loss or theft if the concerned authorities cannot trace it.

Add-ons Available with Bike Insurance Plans.

Apart from the basic third-party and comprehensive insurance coverage, you can also purchase add-ons to increase your protection level. These include the following:

Personal

Accident (PA) Cover

While a basic insurance policy covers damage to your bike and third-party liabilities, a personal accident cover provides financial protection in case of your injury, disability, or death when riding the insured two-wheeler. The compensation scale is 100% in the event of the insured person's death, loss of two limbs, eyesight, or permanent total disablement. The compensation coverage is 50% for losing one limb or eyesight in one eye. You may also purchase PA cover for co-passengers in case of a road accident.

Zero

Depreciation Cover

This add-on covers the depreciation of your bike parts It gives the full claim amount without deducting depreciation on your vehicle components.

24/7

Roadside Assistance Cover

In case of a breakdown, flat tyre, lost key, empty fuel, or urgent repairs, this add-on provides 24/7 roadside assistance within a specified distance. Roadside assistance cover sends you emergency help for towing your vehicle in case of an accident or breakdown, breakdown support over the phone, supply of fuel or keys, message relay, arrangement of a rental vehicle or accommodation, minor repairs, referring a hospital or legal advisor, etc.

Return

to Invoice Cover

In case of a theft or total loss of your bike, you receive the IDV of your insured bike. The add-on bridges the gap between the bike's invoice price and IDV, including taxes and registration

Engine

Protection Cover

As part of a comprehensive bike insurance policy it offers coverage in case of partial or total damage due to water ingression, lubricant oil leakage, or damage due to hydrostatic lock. It also covers damage to all bike engine parts, including crankshafts, connecting rods, pistons, cylinders, etc.

Consumables

Cover

This add-on covers parts necessary for smooth bike operation, including engine oil, chain lubricants, bolts and nuts, coolant, brake fluids, etc.

Coverage

for the Loss of RC or DL

If you lose your driving license or registration certificate or both, this add-on will compensate up to a certain limit for the duplicates.

Emergency

Medical Expenses

If the insured person or the pillion rider gets injured accident, this add-on will reimburse the medical expense up to a certain limit.

Key Features of Hero FinCorp Bike Insurance.

- Minimum insurance premium

- All three types of insurance plans covered, including third-party, standalone, and comprehensive

- No Claim Bonus of up to 50% for five claim-free years

- 100% Personal Accident Cover

- Completely online insurance purchase and renewal

- High claim settlement ratio

- Nil depreciation rate for up to six months

- Accidental hospitalisation and ambulance cover

- Nation-wide coverage

Benefits of Buying Bike Insurance Online.

At Hero FinCorp, you can buy two-wheeler insurance online and enjoy the following benefits:

24/7

Accessbility

Online insurance services are accessible 24/7. Whether you want to buy a new policy, renew one, or raise a claim, you can do it anytime, anywhere, at your convenience. There is no need to wait for the insurance provider's opening hours.

Time-Saving

When buying 2-wheeler insurance online, you don't need to visit the insurer's branch office physically. That means it saves much of the time and effort required for the purpose.

Easy

Comparison

One major benefit of buying bike insurance online is that comparing different insurance plans is easier. You can compare the policies online and choose the one that best suits your requirements.

Factors Affecting Bike Insurance Price.

When comparing insurance policies, you must have noticed that each policy comes with a different premium. Are you wondering why? That is because several factors affect your final bike insurance charges. These include the following:

Here is a list of events that the Hero FinCorp bike insurance covers:

Insurance

Coverage Type

Your insurance premium will largely depend on the type of coverage you opt for, be it a third-party, comprehensive, or standalone policy.

Bike’s

Make and Model

Your bike's make and model affect your premium significantly. For instance, commuter bikes have lower premium rates than high-end motorcycles. The higher the bike's value, the bigger the premium size.

IDV

Your bike's insurance premium will depend on its IDV or Insured Declared Value. Insurance providers calculate it after calculating your bike's approximate market value. Since a premium bike will have a higher IDV, its premium will also increase.

Bike’s

Age

A bike’s market value decreases as it ages. Hence, IDV for a new two-wheeler will be higher than an old bike, increasing its insurance premium.

No

Claim Bonus

No Claim Bonus (NCB) is the discount on premium you can get for not raising any claim during the last few policy years. The longer your claim-free period, the more NCB you can obtain when renewing your insurance policy, reducing your bike insurance charges.

Location

Your geographical location is important in determining your insurance premium. Since the risk of accidents is higher in metro cities, the premiums are on the higher side than in tier-1 and 2 cities.

Factors to Consider when selecting a Bike Insurance Policy.

When selecting a two-wheeler insurance plan, you must check and compare numerous factors. Here are the most crucial factors that will help you choose the right insurance policy:

Coverage

Firstly, approach an insurer providing different bike insurance plans with the desired add-ons. Also, check what’s included and what’s not in their scope of coverage

Process

of Claim Settlement

Opt for an insurance company with a customer-friendly process of settling claims. Check their Incurred Claim Ratio, the percentage of claims settled from the claim made.

Process

for Insurance Renewal

Most insurance plans are valid for a specific period, usually one year After this period, you must renew it to enjoy the benefits. For instance, if it is an annual policy, you must renew it each year before the last date. Therefore, go through the insurer’s renewal process. Ideally, it should be online, fast, and user-friendly.

Customer

Service

The insurance company should have a dedicated customer support team that assists in settling claims and resolving queries while giving preference to their policyholders.

IDV

The insurer should calculate your bike's IDV reasonably. The higher the IDV, the bigger your claim amount will be if the need arises. So, calculate IDVs offered by different insurance plans and opt for the highest one.

Insurance

Premium

Your insurance premium will vary based on factors like your coverage, bike model, IDV, etc Compare bike insurance price for various plans to get the best deal without compromising coverage.

Stepwise Procedure to Buy Bike Insurance Online

Follow the below stepwise procedure to buy two-wheeler insurance online

- Visit Hero FinCorp’s official website

- Scroll to the two-wheeler insurance section.

- Enter the required details regarding your bike and previous insurance, if any.

- Compare the plans and click the 'Buy Now' button against your preferred policy.

- Choose any add-ons you want to purchase.

- Complete the online payment

- Receive the insurance documents on your email ID.

Tips to Reduce Your Bike Insurance Charges.

Here are a few tips to minimise your bike insurance price and save money:

Choose

a Cheaper Bike Model:

Your insurance premium largely depends on its price. The higher the market value, the higher the premium rate. So, opt for a cheaper bike to keep insurance rates under control.

Know

Your Bike’s Correct Market Value:

Although a higher IDV benefits when claiming insurance, it increases your insurance premium. So, know your bike’s correct market value to enter a plan with a reasonable IDV and lower the premium.

Opt

for a Deductible:

Accidents are unpredictable. However, opting for a voluntary deductible will reduce your premium, as you agree to pay some amount from your pocket when asking for a claim.

Use

NCB Discount:

Ensure claiming the No Claim Bonus when renewing your insurance policy. For instance, if you do not make a claim during the last year, you can get up to 20% discount on your premium. The bonus percentage increases with the duration of no claim.

Renew

the Insurance Plan on Time:

Always renew your insurance plan before the due date to retain the NCB benefits. Renewing it on time will save money on insurance premiums.

Install

Anti-Theft Devices:

Many insurance companies offer discounts on premiums if you have ARAI-certified anti-theft devices on your vehicle. Since you have a lower theft risk, the insurer will reward you with a discounted premium.

Our Partners.

FAQs.

Buying two-wheeler insurance online is completely secure. Your information and bike details are confidential through advanced encryption methods no one else can access.

Log in to your account, view your policy document, and click the 'Download' button. You can also download the policy document you must have received at your email address.

Third-party insurance plan covers damages to others due to your bike. Standalone covers only your coverage. A comprehensive plan is the best, as it covers both.

Yes, you can buy insurance for someone else, provided you enter the correct details and documents.

Yes, the bike insurance benefits will transfer to the new owner in that case.

No. You cannot claim bike insurance premiums under Section 80C. Bike insurance is not tax deductible.

Yes, according to the Motor Vehicle Act of 1988, every vehicle running on the road should be insured. Most of the time, the showroom will only let you take the bike out of their premise if you purchase insurance first.

Yes, you can renew your policy online. However, you cannot claim the NCB on your new plan.

Disclaimer.

Hero FinCorp is a registered finance company as Hero Honda FinLease Limited since 1991. Insurance is a subject matter of solicitation. Please refer to our website for policy wording or contact our Corporate Customer Care Help Desk at 1800-103-5271. Tax benefits are applicable per the recent guidelines, as they are subject to change. All information related to the insurance products, including benefits, premiums, add-ons, sum insured, etc., is authentic. T&C Apply.