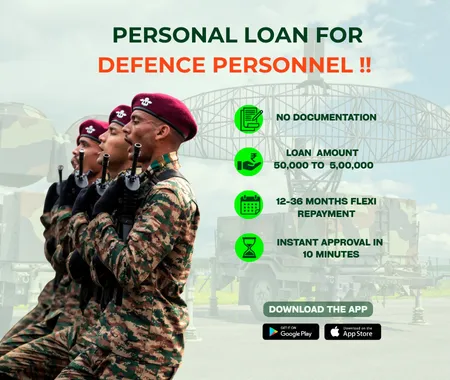

Personal Loan For Defence Personnel.

Need quick funds with minimal paperwork? Hero FinCorp’s Loan for Defence Personnel gives you instant access to money that you can use for any financial need.

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get Personal Loan For Defence Personnel Up to 5 Lakh.

Defence personnel are the pride of our nation, serving in every condition to keep civilians safe. They shouldn’t have to put their dreams on hold due to financial constraints. To support them, Hero FinCorp offers an instant personal loan specifically designed for defence personnel, including those from the Army, Navy, and Air Force. With competitive interest rates, flexible repayment options, and a simple online process, personnel can avail funds quickly. Meeting the eligibility criteria set ensures easy access to loans without collateral, helping our armed forces focus on their duties while Hero FinCorp takes care of their financial needs.

Why Opt Personal Loan for Defence Personnel?

Personal Loans come as a helping hand for those serving in the armed forces, making it easier to take care of personal and professional needs without worry. Here are a few more reasons to consider a personal loan designed for defence personnel.

- Transparent Process: The loan process at Hero FinCorp is entirely transparent. There are no hidden costs, and the online application process is quite simple.

- Quick Approval: Get instant approval in 10 minutes when you apply online.The disbursal is directly into your bank account.

- Special Loan Offers: Specifically designed for defence personnel, these loans offer instant approval and quick disbursal.

- Minimal Documentation: The documentation requirement is minimal. You only need your KYC details and proof of income to complete the application.

Are You Eligible?

Let's Find Out.

Before applying for a personal loan with Hero FinCorp, make sure you meet the eligibility criteria set by the lender. These include your age, monthly income, work experience, and Indian citizenship. The personal loan eligibility criteria are simple and easy to fulfil, making it easy for salaried professionals and self-employed individuals to avail of the loan.

Are You Eligible?

Let's Find Out.

Before applying for a Personal Loan, it’s important to understand the related costs. At Hero FinCorp, the Personal Loan rate of interest and processing fee are nominal. Here are the details of personal loan schemes for the defence personnel.

How to Apply for a Personal Loan for Defence Personnel?

As defence personnel in India, you may not always have the time to go to the lender's branch and fill out the lengthy paperwork. For this reason, we have simplified the process to make borrowing easier for you.

Visit the Hero FinCorp website or download the personal loan app.

On the Instant Personal Loan page, click 'Apply Now'.

Enter your mobile number and register yourself with the OTP received.

Enter your loan amount.

Complete your KYC verification and verify your income eligibility.

Press 'Submit to finalise your online application and get instant approval for your loan.

What do people think about Hero FinCorp.

Kadam Kailash -

Lalji Soni -

Raj Chaudhary -

The latest news.

FAQs.

You can apply for a Personal Loan during medical emergencies, debt consolidation, or planned expenses like home renovation, gadgets, or travel.

You can make the complete loan payment after completing 12 EMIs. Some lenders may charge a foreclosure fee, so you must check before proceeding.

Lenders assess your income, credit score, age, debt-to-income (DTI) ratio and work experience to determine your repayment capacity when approving your loan. Monthly income Debt-to-income ratio Age Credit report Work experience

You should maintain a strong credit score, low DTI ratio, and avoid multiple loan enquiries at once to secure a lower interest rate. Keep your debt-to-income ratio below 50. Avoid applying with more than two lenders at a time. Limit your revolving credit usage. Maintain healthy terms with your existing lenders. Look out for festive loan offers.

You can apply with a creditworthy co-applicant to share your EMI responsibility. Lenders favour applications backed by stable income and good credit profiles.

The Equated monthly instalment, or EMI, of a loan is based on your loan amount, the rate of interest and repayment tenure. The online EMI calculator can help you know the instalment amount instantly.

The salary requirements vary from one lender to the other. For example, at Hero FinCorp, you need an income of at least Rs 15,000 per month.

No. You have to provide your salary slips for loan processing. In case you do not have salary slips, you can provide your bank statements, Form 16 or income tax returns (ITRs).

You can apply in-person at your nearest Hero FinCorp branch or on our website or app. Fill in the application form, provide your KYC details and proof of income, and submit.

Yes, proof of income (like salary slips, bank statements and Form 16) is required for a Personal Loan application. It helps a lender know about your repayment capacity.

Yes, some loan providers may give you a Personal Loan even when you have a low or poor credit (CIBIL) score, but then, you may not get a higher loan amount or lower interest rates.

There are many lending apps that offer instant loans to defence people. For example, the Hero FinCorp loan app offers up to Rs 5 Lakh online.

No. Documentation is essential for loan processing. Online lenders like Hero FinCorp do not ask you to submit physical copies of your documents. You only need your KYC details and income proof.

Due to online application and real-time verification, you can get approval for a Personal Loan from Hero FinCorp in just 10 minutes.