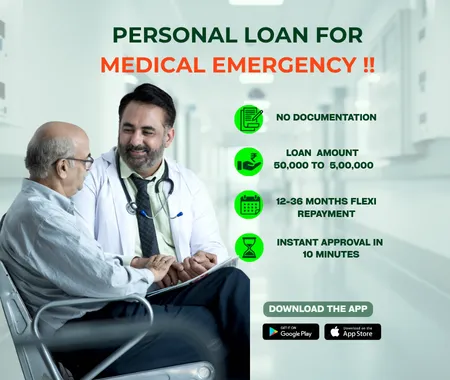

Personal Loan For Medical Emergency.

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get Personal Loan For Medical Use Up to 5 Lakh.

Health emergencies can come with surprise costs and expenses. These can be in the form of hospital charges, surgery, medication and follow-up appointments with your consulting doctors. If you don't have cash on hand or do not wish to use your savings, a Personal Loan for a medical emergency can give you the money you need instantly. Hero FinCorp offers instant Personal Loans to help pay for these costs without hassle. You can apply for a loan online at any time, from anywhere, using your smartphone and our easy to use and secure app or website.

With a monthly income requirement of Rs 15,000, you can easily avail a loan of up to Rs 5,00,000 online, with instant approval in 10 minutes. You can repay the loan over 12 to 36 months at competitive interest rates starting from 1.58% per month. So, why delay? Apply for a Personal Loan for medical emergency through Hero FinCorp and get the money now.

Features and Benefits of Personal Loan For Medical Use.

Before you apply for a personal loan, you must check out the features and benefits of these loans. Here are the key advantages and features of Hero FinCorp’s Personal Loan for medical emergency.

Quick

loan approvals

You can get approval for a personal loan within 10 minutes when you apply online with Hero FinCorp.

No

physical documentation

You do not need to provide physical copies of your document for a Personal Loan at Hero FinCorp.

Flexible

repayment option

You can choose a repayment tenure from 12 to 36 for a Personal Loan for medical emergency.

Loan

EMI calculator

Our online EMI calculator helps you calculate the EMI of your Personal Loan using your loan amount, tenure and interest rate.

Quick

Disbursal

Once approved, the loan gets disbursed to your bank account in no time. You can use the money instantly.

Interest

Rates

The Personal Loan interest rate at Hero FinCorp starts at 1.58%* per month.

How to Apply for a Personal Loan for Medical Use?

You can apply through the Hero FinCorp website or loan app. Here is the stepwise process to apply for a Personal Loan of up to Rs 5 Lakh for medical use online.

Visit the Hero FinCorp website or install the Personal Loan app

Go to the personal loan page and click ‘apply now’

Enter your mobile number and verify with the OTP received

Choose the loan amount you need

Verify your KYC details to check income eligibility

Click ‘Submit’ to complete your application

The latest news.

FAQs.

The minimum and maximum medical loan amounts depend upon the borrower’s financial need as well as the lender’s terms. With Hero FinCorp, you can get from Rs 50,000 to 5 Lakh.

A Personal Loan for medical emergency is an unsecured loan that provides immediate funds to manage medical expenses.

Yes, you can get a Personal Loan for medical emergency to cope up with the expensive medical bills and other related expenses online through financial institutions, NBFCs and online lending institutions.

Lenders prefer a credit score of 750 or above for a Personal loan for medical emergency. However, some lenders may offer you a loan even with a lower credit score.

The documentation requirement for a Personal Loan for medical emergency is minimal. You only need to provide your KYC details and proof of income when you apply with Hero FinCorp online.

You can apply for a Personal Loan of up to Rs 5 Lakh through the Hero FinCorp website or app.

You should be a citizen of India between 21 and 58 years of age, earning at least Rs 15,000, and relevant work experience (salaried: 6 months; self-employed: 2 years) to apply for a Personal Loan from Hero FinCorp.

You can get approval for a Personal Loan for medical expenses in as little as 10 minutes when you apply through our website or loan app.

No, documentation is necessary for loan application. Some lenders, including Hero FinCorp, do not ask you to provide physical copies of your documents when you apply online.

The Personal Loan interest rate depends on your credit score, debt-to-income ratio and policies of the lender. At Hero FinCorp, the interest rates start from 1.58% per month.

Identity proof and income documents are mandatory for medical loan inclusive of Aadhar Card, Salary Slips and Bank Account Statement.

Borrowers can apply for medical loan through online instant loan apps, customer care support or visiting the branch personally.