Personal Loan In Delhi.

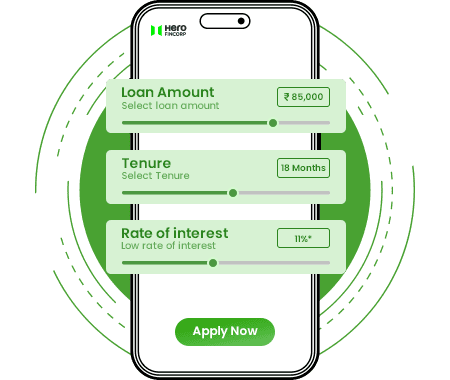

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get a Personal Loan in Delhi Up to 5 Lakh.

Delhi, the capital of India, carries a rich history along with a fast-paced modern life. Its strong infrastructure, iconic architecture, vibrant markets, and constant movement attract people from every background. The city is a major centre for banking, finance, media, telecommunications, and several emerging industries.

With so much activity, the need for urgent Personal Loans stays consistently high, and many lenders cater to this demand. Among them, Hero FinCorp offers simple and accessible loan options for individuals across the city.

Why Choose Hero FinCorp?

Choosing a trustworthy NBFC is crucial for a positive borrowing experience. We offer a simple and reliable process from start to finish.

- Transparent Process: The loan application process is clear and simple. There are no hidden charges, and you can easily complete the application process online.

- Trusted Partner: Trusted by 20M+ Happy Customers Across India for quick and reliable financial support.

- Competitive Interest Rates: We offer competitive interest rates, helping you keep your overall cost low. Our rates start from 19% per annum.

- No Hidden Charges: We offer transparent loan processes with no hidden charges, ensuring clear and straightforward terms.

Features and Benefits.

When you apply for a Personal Loan online, it’s important to choose a lender who offers a fair deal and a smooth experience. Here are some key features and benefits of our Personal Loans:

Flexible

Repayment

Choose a loan tenure of up to 60 months (5 years), which gives you ample room to plan your repayment comfortably (original content stated 36 months, updated for competitive market standards).

Fast

Processing

With a paperless process and quick loan approval, you can get funds disbursed without unnecessary delays. Approval is often granted in 10 minutes, subject to final verification and documentation.

Unsecured

Loan

You don’t need to provide any collateral, making the process easier and stress-free.

High Loan Amount

You can get a loan amount of up to ₹5 Lakh, depending on your needs and eligibility.

Are You Eligible?

Let's Find Out.

To apply for a loan in Delhi, you must meet the basic eligibility criteria for a Personal Loan.

Are You Eligible?

Let's Find Out.

We offer competitive interest rates on Personal Loans. As a responsible NBFC, we adhere to the RBI’s Fair Practices Code (FPC) regarding transparency in all charges. Here’s a quick look at the other charges you should know about.

Uses of Personal Loan in Delhi.

Personal Loans are flexible, which makes them useful for many different needs.

Medical

Emergencies

Personal Loans help you manage urgent medical bills and treatments by giving you quick access to the funds you need.

Weddings

and Family Functions

You can use the loan amount to finance venue costs, catering, outfits, and décor without affecting your savings.

Home

Renovation

A Personal Loan can cover repairs, upgrades, and new appliances to improve your home.

Education

and Skill Development

You can use the loan amount to finance tuition, exams, or certification courses.

Travel

Personal Loans make it easy to plan domestic or international trips by covering travel and stay expenses.

How to Apply For a Personal Loan in Delhi?

Applying for a Personal Loan in Delhi is easy. You can complete the loan application process online or at a nearby branch in just a few steps.

The latest news.

FAQs.

You can choose a loan tenure ranging from 12 to 36 months.

Visit the website, go to the Personal Loan section, click Apply Now, fill in your details, complete the required steps, and submit your loan application.

The interest rates for Personal Loans in Delhi start from 1.58% per month.

With a salary of Rs 15,000 per month, you can get a loan amount of up to 5 Lakh, depending on factors like your credit score and debt-to-income ratio.

Yes, self-employed professionals and business owners can easily apply for a Personal Loan.

You can calculate your EMI instantly using the Personal Loan EMI Calculator on the website. Just enter your loan amount, interest rate, and repayment tenure.

Yes, you can use a Personal Loan for any personal need since it is an unsecured loan with flexible usage.

No, you can apply for a Personal Loan in Delhi without any collateral, as it is an unsecured loan.

The minimum income required to meet the eligibility criteria for a Personal Loan is Rs 15,000 per month.

Yes, you only need to provide your KYC details to complete your loan application.

Apply online through the website or loan app. If you meet the criteria for a Personal Loan, you can get loan approval within 10 minutes.

Yes, you may still qualify, but the loan amount may be lower, and the rate of interest can be higher.

The loan app offers one of the fastest approvals. If you meet the eligibility criteria, you can get loan approval within minutes.

The loan application process is completely paperless. You only need your KYC details to apply for a Personal Loan.

Hero FinCorp is a preferred choice for Personal Loans in Delhi because it offers quick processing and a simple, transparent online journey that makes borrowing easier from start to finish.