Personal Loan In Hyderabad.

Get Personal Loan in Hyderabad Up to 5 Lakh.

Think of Hyderabad and the first things that come to mind are usually its delicious biryani or the Charminar standing tall in the middle of a lively market. While celebrated for its rich heritage, Hyderabad has grown into a major centre for IT, data science, civil engineering, dairy, electric vehicles, and several other industries. This steady growth, along with rising job and business opportunities, has drawn people from across the country. Naturally, the demand for Personal Loans in Hyderabad has also gone up, especially among those who prefer an instant online loan with a fully paperless process. Securing quick and affordable credit is essential for managing immediate financial needs in a fast-growing metro like this. While several lenders operate in the city, not all offer quick and convenient Personal Loans with attractive interest rates the way Hero FinCorp does.

Why Choose Hero FinCorp?

Finding the right lender matters when you want a quick and stress-free borrowing experience, and that’s exactly what Hero FinCorp aims to deliver through a transparent and efficient digital process.

- Fast Approval Get quick approval supported by a smooth loan application process.

- Easy Online Access Apply for an instant Personal Loan online with no paperwork.

- No Collateral Needed Avail an unsecured Personal Loan without any collateral or guarantor.

- Affordable Borrowing Benefit from competitive interest rates that keep the loan costs manageable.

- Flexible Repayment Choose flexible repayment options that suit your monthly budget.

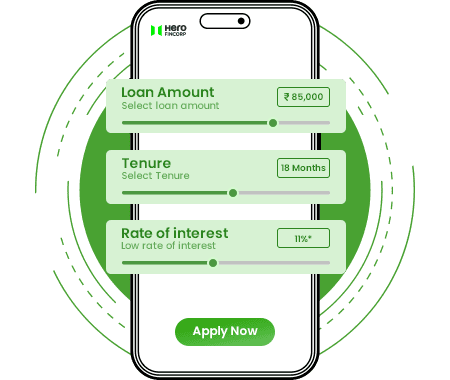

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Features and Benefits.

Apply for a Personal Loan in Hyderabad and enjoy the following features and benefits of our instant loan product.

Unsecured

Loan

You don't need any collateral or guarantor to obtain a Personal Loan, making the application process simple and quick. This is a standard feature for Personal Loans across the NBFC sector.

Multipurpose

Loan

A Personal Loan can be used for many needs, including home renovation, travel, or a medical emergency.

High

Loan Amount

We offer an instant loan of up to Rs 5 Lakh with a 100% digital process, helping you get the loan amount you need without hassle.The final approved amount depends on your eligibility.

Flexible

Tenure

You can choose a repayment tenure of 12 to 36 months based on your income and expenses.

Are You Eligible?

Let's Find Out.

To apply for a Personal Loan in Hyderabad, you must meet the basic eligibility for a Personal Loan. Below is the list of requirements:

Are You Eligible?

Let's Find Out.

At Hero FinCorp, the Personal Loan interest rate in Hyderabad is competitive, but it’s equally important to be aware of the other fees involved. These charges also shape your total loan repayment cost. Here are the key ones you should know about:

Uses of Personal Loans in Hyderabad.

Personal loans help you manage planned or urgent expenses without touching your savings. Here are the most common uses:

Travel

Costs

You can take a Personal Loan to fund vacations, family trips, or long-awaited getaways. It can be used for shopping, flight bookings and other related expenses.

Wedding

Expenses

A Personal Loan can help manage wedding costs, from venue bookings to last-minute arrangements, giving you the freedom to plan smoothly.

Home

Renovation

A Personal Loan can be used for home renovation. It lets you upgrade interiors or repair old structures. You apply for an online Personal Loan anytime.

Medical

Emergencies

You can get a Personal Loan during medical emergencies for quick financial support when immediate care is needed.

How to Apply For a Personal Loan in Hyderabad?

Applying for an instant Personal Loan in Hyderabad is easier than you can imagine. You can apply online through our website or the dedicated mobile application.

Visit the website or install the Personal Loan app.

Go to the online Personal Loan page and click ‘Apply Now’.

Enter your mobile number and verify it with the OTP received.

Choose the Personal Loan amount you need.

Verify your KYC details.

Click ‘Submit’ to complete the loan application process.

Before applying, check your eligibility for Personal Loans on our website.

FAQs.

A higher income shows the lender that you can make the loan repayment comfortably. This improves your chances of getting approved for a Personal Loan in Hyderabad.

No. A Personal Loan is unsecured, so no collateral or guarantor is needed.

There are many factors like your age, credit score, and debts before deciding your Personal Loan amount.

You can get loan approval within 10 minutes when you apply online through the website or loan app.

Personal Loan interest rate in Hyderabad starts from 19% per annum.

You can get the loan amount up to Rs 5 Lakh, based on your income and credit score.

Yes, Self-employed people can easily get a Personal Loan in Hyderabad if they meet the eligibility criteria.

The loan application process is fully digital. You only need your KYC details to apply online.

You can know the status of your Personal Loan application online through the loan app or customer care.

Certainly, you can use a Personal Loan for health-related purposes or medical emergencies without hesitation as these are unsecured loans with flexible usage.

You can calculate your EMI instantly using the personal loan EMI calculator available on the website. You just require your loan amount, interest rate and repayment tenure.

Yes. Personal Loan can be used for various purposes, like home renovation or other needs.