Personal Loan In Chennai.

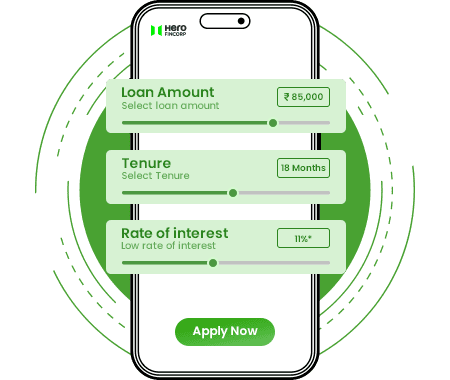

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get Instant Personal Loan in Chennai Up to Rs 5 Lakh.

Chennai, the capital of Tamil Nadu, is often called India’s cultural capital. The city has a rich past and proudly keeps its old traditions alive. At the same time, Chennai is a major business, education, and trade hub in South India. It attracts students, working professionals, and entrepreneurs year-round. This steady growth has increased demand for quick Personal Loans. If you're looking for a reliable Personal Loan in Chennai, you can apply online on the Hero FinCorp website or loan app. You can get an instant Personal Loan approval within minutes, subject to successful verification.

Are You Eligible?

Let's Find Out.

Personal Loans are unsecured loans available to both salaried and self-employed individuals with a minimum monthly income of Rs 15,000. You can apply online anytime without any documents and collateral. Hero FinCorp makes securing a Personal Loan simple, fast, and completely hassle-free. Here is what makes it stand out:

- Instant Approval in 10 Minutes: You don't have to wait long. Get quick approval for an instant Personal Loan online.

- No Security or Collateral Needed: You can apply for a Personal Loan without any security or collateral. This is helpful when you want to opt for a Personal Loan without risking assets.

- 100% Digital Journey: The entire loan application process, from start to finish, is online and paperless so you can get an online Personal Loan anytime.

- Flexible Tenure: Choose a repayment plan that fits your budget. Use the Personal Loan EMI Calculator to choose the right loan amount and enjoy flexible repayment options.

- 24/7 Emergency Financial Support: You can get a loan urgently online through our instant loan app.

Features And Benefits.

Personal Loan in Chennai has many more benefits than instant approval. Some of them are:

Competitive

Interest Rates

Our rate for a Personal Loan starts from 19% per annum, making repayments manageable. Borrowers with a strong profile may get a lower interest rate.

High

Loan Amount

You can get a personal loan of up to Rs 5 Lakh online for various purposes based on your Personal Loan eligibility.

Multipurpose

Loan

Personal Loans can be used for travelling, higher education, home renovation or any other personal needs.These loans provide quick access to funds without paperwork.

Unsecured

Loans

Personal Loans are unsecured loans, which means you do not need to provide any security or collateral.

Are You Eligible?

Let's Find Out.

To apply for an instant loan in Chennai, the following Personal Loan eligibility criteria must be fulfilled.

Are You Eligible?

Let's Find Out.

Our Personal Loan interest rates in Chennai are nominal. So, you don't need to worry about paying exorbitant charges in addition to the principal amount you borrow. Here are our personal loan interest rates and applicable charges.

How To Apply For a Personal Loan in Chennai?

Get instant Personal Loan approval in Chennai without hassle. To initiate your loan application, either visit our website or install the loan app.

Purpose of Taking Personal Loans in Chennai .

Personal Loans in Chennai are popular as they offer quick support when you need funds fast. Whether you’re planning something important or dealing with an urgent expense, an instant Personal Loan can help you manage costs with ease.

Common purposes include:

- Travel expenses for domestic or international trips

- Wedding costs such as venue, décor, and catering

- Home renovation and repair work

- Medical emergencies and hospital bills

- Education-related expenses

- Buying gadgets or appliances

- Managing debt or credit card dues

What do people think about Hero FinCorp.

Kadam Kailash -

Lalji Soni -

Raj Chaudhary -

FAQs.

Your credit history shows how you have managed loan and credit card payments. It helps lenders assess your creditworthiness and approve your loan quickly.

You only need to provide your KYC details (PAN and Aadhaar card numbers) to apply for a Personal Loan online.

No, you don't need to provide your valuables as collateral. We offer a Personal Loan based on your income, credit history, and some other factors.

You can know the status of your Personal Loan application online through loan app or customer care.

Of course, you can avail a Personal Loan for health issues or medical emergencies without any hesitation because these are unsecured loans with flexible use.

There are no special schemes available in Chennai right now. But if you have a good credit score, a stable income and a low debt-to-income ratio, you can easily avail a loan with better terms.

You can repay your Personal Loan online via auto-debit facility to prevent defaulting on EMI payments.

You can calculate your EMI instantly using the Personal Loan EMI Calculator available on the website. You just require your loan amount, interest rate and repayment period.