Personal Loan for Corporate Employees.

Get a Personal Loan For Corporate Employees Up to 5 Lakh .

Being a corporate employee, you most likely have a fixed salary and have to manage everything within the limit. You have to budget for everything, including household expenses or a trip to a new destination. When a financial emergency arises, it can be tough to manage. Hero FinCorp's Personal Loan for corporate employees can help in such situations. You can apply for a Personal Loan for Corporate Employees online and receive up to Rs 5 Lakh with minimal documentation. The interest rates are competitive and loan tenures are flexible. The application can be approved in 10 minutes, which is helpful in an emergency situation.

Why Opt for a Personal Loan for Corporate Employees?

The instant Personal Loan for corporate employees is an unsecured lending solution that can be utilised for both unforeseen and planned financial obligations. The interest rates are competitive, thus allowing for easier repayment of your loan amount. Additionally, you can select the tenure according to your monthly obligations. Here are a few reasons why you should consider a Personal Loan for corporate employees.

Special

Loan Offers

Our loans for corporate employees are designed keeping in mind the borrower's needs, as they offer competitive interest rates, flexibility, instant approval and more.

Minimal

Documentation

Hero FinCorp has minimal documentation requirements for the loan application, you only need the KYC requirement and proof of income.

Quick

Processing & Disbursement

You can receive loan approval in 10 minutes online, with quick disbursal to your bank account.

Simple

& Transparent Process

There are no hidden fees or charges related to a Personal Loan at Hero FinCorp, which makes the borrowing process easier.

Features and Benefits of Personal Loan for Corporate Employees.

Personal Loans have several advantages that make them the most preferred borrowing option. Before you apply for a Personal Loan for corporate employees, you must check out the features and benefits of these loans. Here are the key features and advantages of Hero FinCorp's Personal Loan for corporate employees.

Unsecured

Loan

Get funds without collateral by meeting basic income and credit requirements.

Collateral-Free

You do not need to provide any security or collateral to avail a Personal loan for Corporate Employees.

Flexible

Usage

Use the loan for higher education, home renovation, travel, or emergencies.

Flexible

Repayment Tenure

You can choose a repayment tenure of 12 to 36 months, based on your budget.

Higher

Loan Amount

Get up to Rs 5,00,000 to manage financial needs and emergencies.

Instant

Approval

You can get approval in just 10 minutes when you apply for a Personal Loan online with Hero FinCorp.

Competitive

Interest Rate

Our loan interest rates start from 1.58% per month.

High

Loan Amount

As a corporate employee, you can get a personal loan up to Rs 5 lakh for various planned and unplanned expenses.

Attractive

Interest Rate

The Personal Loan interest rates at Hero FinCorp start from 1.58% per month or 19% per annum.

Are You Eligible?

Let's Find Out.

To apply for a Personal Loan for Corporate Employees, make sure you meet the eligibility requirements, including your age, monthly income, work experience, and citizenship. At Hero FinCorp, the Personal Loan eligibility criteria are simple and easy to fulfil.

- •Citizenship: You should be a citizen of India.

- •Age Requirement: You must be between 21 to 58 years to be eligible for the loan.

- •Work Experience: You should have at least six months experience in your current job.

- •Monthly Income: The minimum monthly income required is Rs 15,000.

Are You Eligible?

Let's Find Out.

Before you apply for an instant Personal Loan for corporate employees, it’s important to know the related costs, like the interest rate and processing fees. At Hero FinCorp, the Personal Loan interest rates are competitive, and other charges are nominal. Here are the details

How to Apply for a Personal Loan for Corporate Employees.

As a corporate employee, you can apply for a personal loan online through our website or in person at your nearest Hero FinCorp branch. The details of both these processes are listed below.

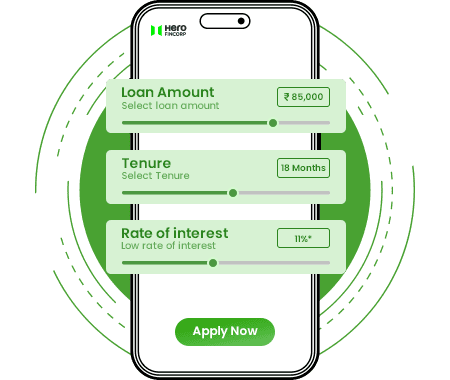

Online Process

Visit the Hero FinCorp website or install the personal loan app

Go to the Personal Loan page and click ‘Apply Now’

Enter your mobile number and verify with the OTP received

Choose the loan amount you need

Verify your KYC details to check income eligibility

Click ‘Submit’ to complete your application

What do people think about Hero FinCorp.

Kadam Kailash -

Lalji Soni -

Raj Chaudhary -

The latest news.

FAQs.

There are several factors that play a part in determining your personal loan interest rate. These include the following: Your credit score Your credit report remarks Your work experience and employment status Your salary

You can apply at your nearest Hero FinCorp branch or on our website or app with KYC documents and proof of your income.

Check your eligibility and gather the required documents. Based on your preference, apply online and offline. You can get approval in 10 minutes when you apply on the Hero FinCorp website or loan app.

Yes, the documentation requirement for a Personal Loan for corporate workers is minimal at Hero FinCorp. You only need your KYC details and proof of income.

As a corporate employee, you can apply for an instant Personal Loan from financial institutions, NBFCs and online lending institutions like Hero FinCorp.

You can get approved for a Personal Loan for corporate employees in 10 minutes or less when you apply through the Hero FinCorp website or loan app.

Yes, at Hero FinCorp, we offer Personal Loans for corporate employees with a repayment tenure ranging from 12 to 36 months.

Yes. As a corporate employee, you can readily apply for a Personal loan online. You can avail up to Rs 5 Lakh according to your needs and eligibility whenever you need.

No, documentation is an important requirement of the loan application process. Some NBFCs like Hero FinCorp may not ask you to submit physical copies of your documents when you apply online.

Yes, a corporate employee can obtain a Personal Loan with a low or poor CIBIL score. However, the lender may offer a smaller loan amount or charge a higher interest rate.

As a corporate employee, you can avail a Personal Loan of up to Rs 5,00,000 for any personal or professional purpose.