Personal Loan for Chartered Accountant (CA).

Worried about funding your CA practice? Apply for a personal loan for Chartered Accountants today and get the support you need to grow your career with confidence.

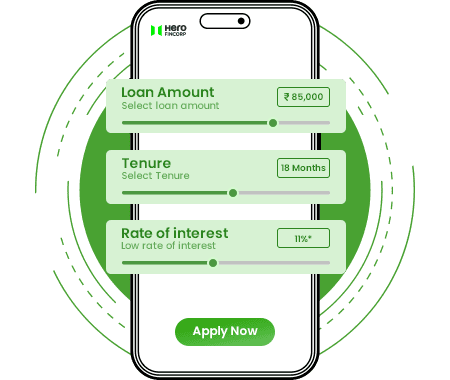

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get Personal Loan For Chartered Accountant Up to 5 Lakh.

Managing money for clients is one thing, but arranging funds for your own practice can be a significant challenge. Starting a CA firm may require additional funds for office rent, furniture, stationery, or working capital. A Chartered Accountant professional loan can assist you with that. With Hero FinCorp, you can apply online for up to Rs 5 Lakh. The loan is collateral-free, has competitive interest rates, and flexible repayment options. The process is quick, with minimal paperwork and fast approval, allowing you to focus on advancing your career without financial stress.

Why Choose a Personal Loan for Chartered Accountants (CAs)?

A personal loan for Chartered Accountants can make managing finances much easier. Here’s why you should consider it:

Funds

for Any Need

Use the loan for personal or professional expenses.

No

Collateral Required

You don't have to put up property, gold, or other assets as collateral to apply.

Flexible

Repayment Terms

You can choose a repayment period of 12 to 36 months, and your EMIs will be based on what you can afford.

Quick

Loan Disbursal

You can get the money you borrowed right away in your bank account.

Competitive

interest rates

Rates start at just 1.58% per month, which makes it easier to pay off EMIs.

Features and Benefits of Personal Loan for Chartered Accountant (CA).

Before you consider applying for a Personal Loan for CA, you must look at the features and benefits of these loans. Here are some advantages and features of a Hero FinCorp Personal Loan for CAs.

Zero

Collateral

Get funds without pledging assets, ensuring financial flexibility for growth.

Collateral-Free

Our personal loans for CAs are unsecured. You do not have to provide any security, collateral or guarantor.

Flexible

Repayment Tenure

Choose a repayment tenure that suits your budget and affordability.

Flexible

Repayment Tenure

You can select a repayment tenure from 12 to 36 months based on your finances.

Multi-Purpose

Loan

You can use funds for business expansion, personal needs, or unexpected expenses.

Instant

Approval

You can apply online using the Hero FinCorp website or app to get approval in 10 minutes.

Quick

Approval

Fast processing ensures quick access to funds when you need them.

High

Loan Amount

As a CA, you can get a personal loan of up to Rs 5 lakh for various planned or unplanned expenses.

Attractive

Interest Rate

The Personal Loan interest rates at Hero FinCorp start from 1.58% per month or 19% per annum.

Are You Eligible?

Let's Find Out.

To apply for a personal loan for Chartered Accountant, you need to meet a few eligibility requirements, such as age, monthly income, work experience, and citizenship.

Interest Rates and Charges on Personal Loan For Chartered Accountant.

Before applying for an instant personal loan for CAs, it is important to understand the related costs, including the personal loan interest rate and processing fees. At Hero FinCorp, the available interest rates are competitive, and other charges are nominal. Review the details carefully before applying for a CA loan to plan your finances better.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting from 1.58% per month |

| Loan Processing Charges | Minimum 2.5% + GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Online loan app does not charge any cancellation charges |

| 2. Interest amount paid is non-refundable | |

| 3. Processing charges are also non-refundable |

Interest

Rate

Starting from 1.58% per month

Loan

Processing Charges

Minimum Processing fee is 2.5%+ GST

Prepayment

Charges

N.A.

Foreclosure

Charges

5% + GST

EMI

Bounce Charges

Rs 350/-

Interest

on Overdue EMIs

1-2% of the loan/EMI Overdue Amount Per Month

Cheque

Bounce

Fixed Nominal Penalty

Loan

Cancellation

1. Online loan app does not charge any cancellation charges

2. Interest amount paid is non-refundable

3. Processing charges are also non-refundable

How to Apply for a Personal Loan for a Chartered Accountant (CA)?

At Hero FinCorp, we are aware that your time is precious. For this reason, you can apply for a personal loan both online and offline. Here's how you can do so in a few simple steps.

Online Process

Visit the Hero FinCorp website or download the personal loan app.

On the Instant Personal Loan page, click on 'Apply Now'.

Enter your mobile number and register yourself with the OTP received.

Enter your loan amount.

Complete your KYC verification and verify your income eligibility.

Press 'Submit' to finalise your online application and get instant approval for your loan.

What do people think about Hero FinCorp.

Kadam Kailash -

Lalji Soni -

Raj Chaudhary -

The latest news.

FAQs.

A Personal Loan for a chartered accountant is available for the maximum sum of Rs 5,00,000. However, the loan sum that you can acquire depends on your credit score, income, income-to-debt ratio, age, and several other factors.

When applying for a Personal Loan for Chartered Accountants, consider factors like loan amount, interest rates, repayment tenure, eligibility criteria, and required documents. Hero FinCorp offers quick approvals, flexible terms, and zero-collateral loans, ensuring easy access to funds

When applying for a Personal Loan for Chartered Accountants, consider factors like loan amount, interest rates, repayment tenure, eligibility criteria, and required documents. Hero FinCorp offers quick approvals, flexible terms, and zero-collateral loans, ensuring easy access to funds

If you apply with Hero FinCorp, we will require your KYC documents, such as your Aadhaar or PAN card. In addition to that, we would require proof of firm existence, business continuity, and documentation supporting your income.

You can reduce your monthly debt burden by choosing a longer repayment period. However, extending your tenure will result in a higher total interest payable. Another option for lowering your EMI is to make a partial prepayment.

To be eligible for a Personal loan from Hero FinCorp, you must be a citizen of India between the ages of 21 and 58 years, and should have requisite work experience of six months for salaried individuals and 2 years for self-employed individuals.

Your credit score is determined based on a thorough assessment of your credit report. It reflects your credit behaviour. A good credit score indicates that you have never defaulted on a loan and have always paid your loan EMIs timely. It gives the impression that you are a responsible borrower and would make regular payments to pay back the debt. This will classify you as a low-risk borrower and the lender may offer you a better interest rate and higher eligibility amount.

Yes. As a CA, you can readily apply for a Personal loan for CAs. You can avail up to Rs 5 Lakh according to your needs and eligibility whenever you need.

If you apply with Hero FinCorp, we will require your KYC documents, such as your Aadhaar or PAN card. In addition to that, we would require proof of firm existence, business continuity, and documentation supporting your income.

You can get a Personal Loan for CA online using the Hero FinCorp website or loan app and receive funds in as little as 10 minutes.

The interest rate on a Personal Loan for CAs will depend on your credit score, debt-to-income (DTI) ratio and lender's policies. Personal loan interest rates offered by Hero FinCorp currently start at 1.58% per month.

Yes, a CA can obtain a Personal Loan with a low or poor CIBIL score. However, the lender may offer a smaller loan amount or may charge a higher interest rate.

Yes, you can get approved for a Personal Loan for an emergency in 10 minutes or less when you apply through the Hero FinCorp website or loan app.

Chartered accountants can secure attractive interest rates, flexible repayment terms of up to 36 months and fast loan approval (within 10 minutes) when applying for a Personal Loan with Hero FinCorp.

As a chartered accountant, you can avail a Personal Loan of up to Rs 5,00,000 for any personal or professional purpose.