Used Car Loan in Bhimavaram.

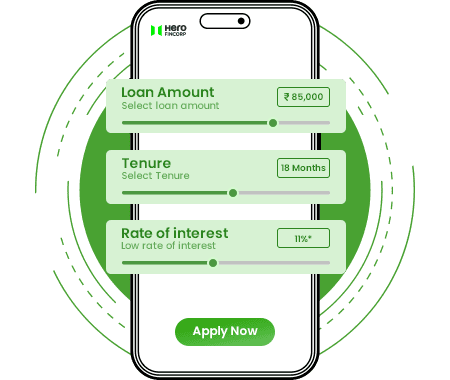

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get Used to Car Finance in Bhimavaram with Quick Approval.

Bhimavaram is famed for its picturesque landscapes, rich tradition, and historical significance, making it a popular tourist destination. Furthermore, the warm hospitality adds to its charm, attracting visitors to the city.

Bhimavaram's history is centuries old, with attractions like temples, heritage landscapes, and natural beauty-oriented destinations for travellers. However, in such a place, convenience is one of the major aspects of travel, making exploring places in Bhimavaram easy and remarkably stress-free.

Having a car is a great way to explore the city. However, buying a new car may stress your finances. So, it’s good to prefer a pre-owned car in Bhimavaram.

Hero FinCorp offers used car finance in Bhimavaram with attractive interest rates, flexible repayment tenures and quick approval.

Features And Benefits of Hero FinCorp Second-Hand Car Loan in Bhimavaram.

Hero FinCorp offers exciting and pocket-friendly features, making buying your dream car easy and achievable. Hero FinCorp's Used Car Loans in Bhimavaram offer high loan amounts with instant approval tailored to address customers' financial concerns, ensuring solutions that are accessible, convenient, and affordable.

High

Loan Amount

Hero FinCorp offers substantial Used Car Loans ranging from Rs 0.5 Lakh to Rs 50 Lakh in Bhimavaram.

Attractive

Interest Rate

Hero FinCorp offers competitive interest rates starting at 12.5% per annum.

Collateral-Free

Borrowers can avail of used car finance for private vehicles without any collateral requirement.

Flexible Repayment Tenure

There are repayment options for up to 5 years.

Instant

Approval

Experience quick and easy loan approval with Hero FinCorp in Bhimavaram.

Are You Eligible?

Let's Find Out.

If you are planning to take out a second-hand car loan in Bhimavaram, you must understand whether you are eligible and whether you meet the required criteria.

- •Age: Applicants should be at least 18 years of age.

- •Citizenship: Indian citizenship is a prerequisite.

- •Work Experience: The applicants should have a minimum of one year of work experience.

- •Monthly Salary: We do not have predefined minimum monthly income criteria.

Interest Rates on Used Car Loans in Bhimavaram.

You can enjoy the advantages of competitive rates, making it easier to fulfil your dream of owning your desired car without straining your finances or budget. Hero FinCorp provides competitive Used Car Loan interest rates in Bhimavaram, starting from 12.50% per annum.

Pre-Owned

Car Loan Interest Rates

Starting from 12.5% to 26%

Loan

Amount

Rs 50,000 (Min) – Rs 50,00,000 (Max)

Loan

Tenure

12 Months (Min.) – 60 Months (Max)

Loan

Processing Fees

0.5% - 4%

Prepayment

Charges

5% on Principal outstanding (additionally interest up to 6 months for foreclosures within 6 months from date of disbursement)

Other

Charges

As applicable

How to Apply For a Pre-Owned Car Loan in Bhimavaram?

Applying for private finance for a used car in Bhimavaram with Hero FinCorp is a simple and easy process. Whether applying in person or online, the process at Hero FinCorp ensures convenience and efficiency.

Visit our Used Car Loan page.

Enter the required loan amount, interest rate and tenure in the EMI calculator. It will give you an estimate about the EMI you have to pay.

Under “Apply for a Loan”, provide the correct personal and professional details along with your mobile number and OTP received.

Then agree to the Terms & Conditions by ticking the checkbox and click on “Submit”.

The latest news.

FAQs.

Yes, Hero FinCorp offers Used Car Loans ranging from Rs 0.5 Lakh to Rs 50 Lakh in Bhimavaram.

Yes, with Hero FinCorp, you can easily get customised, affordable, and easily accessible second-hand car loans with minimum documentation.

Hero FinCorp offers competitive interest rates starting at 12.50% per annum on pre-owned car loans in Bhimavaram.