Personal Loan for Self Employed.

Managing unexpected business costs or personal financial needs can be challenging for entrepreneurs. A Personal Loan for Self-Employed individuals offers a fast and 100% digital financing solution to help keep your growth on track. Apply online.

Get a Personal Loan for Self-Employed Up to 5 Lakh.

Personal Loan for self-employed professionals is a simple and reliable way to manage business or personal needs. Whether you want to expand your business, manage working capital, renovate your home, travel, or plan a wedding, this loan offers the flexibility you need.

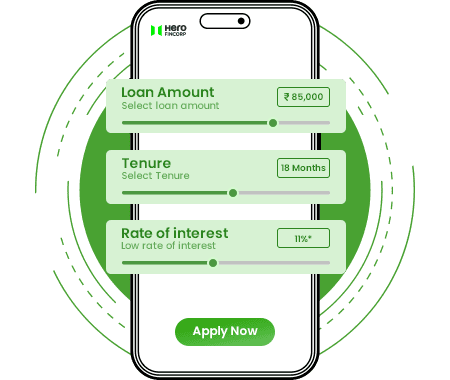

If you have been self-employed for at least two years, you can easily apply online through a quick and hassle-free process. Borrow between Rs 50,000 and Rs 5 Lakh at competitive interest rates without collateral or guarantor. You can also use the Personal Loan EMI Calculator to explore different repayment tenures ranging from 12 to 36 months.

Features and Benefits.

As a self-employed professional or business owner, you can secure an instant personal loan online to manage various financial requirements without pledging collateral.

Digital

Loan Application

Apply for your personal loan for self-employed individuals through our website or verified loan app for self-employed professionals, eliminating paperwork.

Instant

Verification

Our real-time KYC verification process ensures instant approval and quick disbursal.

Small

Cash Loans

You can get loans for self-employed from Rs 50,000 to 5 Lakh with a 100% paperless process.

Attractive

Interest Rates

You can get loans at competitive rates starting from 19% per annum or 1.58% per month.

Quick

Disbursal

Once approved, the loans are directly credited to your bank account in no time.

Automated

Repayment

Our auto-debit facility ensures timely EMI payments, simplifying the loan repayment process.

How to Apply for a Personal Loan for Self-Employed?

Starting a new venture or expanding an existing business often needs the right financial boost. Getting an Instant Loan for self-employed professionals is quick, simple, and entirely online. Here’s how you can apply:

Visit the website to start your online application.

Go to the Instant Personal Loan section and click ‘Apply Now’.

Enter your mobile number, verify it with the OTP, and begin your application.

Choose the loan amount that fits your needs.

Complete your KYC verification, and use the Personal Loan EMI Calculator to plan repayment.

Click ‘Submit’ to finish your application.

Purpose of Taking a Quick Personal Loan for Self-Employed.

An Instant Loan for self-employed individuals provides quick, 100% paperless access to funds for various business or personal needs. It’s perfect for entrepreneurs, freelancers, and small business owners who want financial flexibility without affecting their savings.

Here are some common uses:

- Business expansion: Upgrade equipment, increase inventory, or improve office space.

- Working capital: Maintain smooth operations during slow months.

- Debt consolidation: Simplify multiple payments into one manageable EMI.

- Personal expenses: Handle home renovation, travel, or family costs.

- Emergencies: Access instant funds for urgent medical or unexpected needs.

Steps to Download a Self-Employed Loan App.

Downloading the Self-employed loan app is the first step toward getting a loan quickly and easily. The app offers a 100% paperless process, instant approvals, and flexible repayment options. Follow these simple steps to get started:

- Open the Google Play Store or Apple App Store on your phone.

- Type Hero FinCorp Loan App in the search bar.

- Tap on Install to download the app.

- Once installed, tap Open to launch it.

- Register with your mobile number to get started.

How to Apply for a Self-Employed Personal Loan App?

Applying for a loan through a self-employed personal loan app takes just a few minutes. Here’s how you can do it:

- Open the loan for self-employed app on your smartphone.

- Choose the loan amount and preferred EMI.

- Input the required details.

- Complete your e-KYC process.

- Enter your bank account details.

- Get real-time approval of the loan.

- Sign the e-Mandate and loan agreement online.

- Get the loan amount directly in your account.

The latest news.

FAQs.

A self-employed individual can get a Personal Loan ranging from Rs 50,000 to Rs 5 Lakh with instant approval.

The Self-employed Personal Loan app offers instant approval, flexible repayment options, and a competitive interest rate, making it a trustworthy loan app for self-employed individuals.

Apply through the Hero FinCorp instant loan app's paperless document process. Upon successful verification, the loan is approved and the amount is credited to your bank account.

You can apply online through the self-employed Loan App or website, complete KYC verification, and receive instant approval.

Self-employed individuals between the age group of 21–58 years with a monthly income of Rs 15,000 or above and a valid KYC can apply for an online Personal Loan.

Applying for a Personal Loan for the self-employed is a 100% paperless process. You just need to provide KYC details (Aadhaar and PAN card) to complete the application.

You can expect instant approval on websites and loan apps in 10 minutes. After approval, the loan amount is credited to your account quickly.

A self-employed person needs a minimum monthly income of Rs 15,000 to be eligible for a Personal Loan, in addition to meeting age and document requirements.

You can get a Personal Loan just by providing your KYC details (Aadhaar and PAN card).

Yes, it is possible, but challenging. However, you may not get a higher loan amount or a lower interest rate.

Hero FinCorp loan app provides instant Personal Loans to self-employed individuals with flexible repayment terms, a 100% digital process, and approval within 10 minutes.

Yes, you are not required to submit any physical documents. You just need your KYC details to complete your application.