Doctor Loan.

Need funds to set up a clinic or manage personal expenses? A doctor loan helps you meet both professional and personal financial needs, letting you focus on treating patients and growing your medical practice with confidence.

Get Personal Loan For Doctors Up to 5 Lakh.

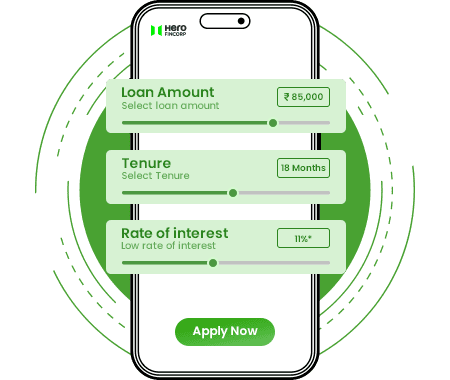

Instant Personal Loans for doctors are exclusively designed to provide timely finance to healthcare professionals. You might need quick funds for setting up a clinic, purchasing medical equipment, or managing personal finances. Apply for a loan for doctors at Hero FinCorp to cover the cost upfront and repay later through EMIs over a tenure of 12 to 36 months.

The loan amount from Rs 50,000 to Rs 5 Lakh comes with a competitive interest rate starting at 19% per annum. Borrow a Personal Loan for doctor without visiting the branch or dealing with any paperwork. The application process is 100% online, and the amount is disbursed directly into your bank account within a short period.

Why Choose Hero FinCorp for Short Term Personal Loan?

A professional loan for doctors can be a real support for doctors, helping them manage expenses with ease. Here’s why this loan offer is an ideal choice for doctors:

- Transparent Process: The loan application process at Hero FinCorp is entirely transparent. There are no hidden costs, and the online application process is quite simple.

- Quick Disbursement: Get instant approval in 10 minutes when you apply for doctor loan online. The disbursal is directly into your bank account.

- Special Loan Offers: Specifically designed for salaried employees, these loans offer instant approval and quick disbursal.

- Flexible Repayment Tenure: Enjoy repayment flexibility with loan tenures of up to 36 months.

Features and Benefits of Personal Loan For Doctors.

Personal Loans for doctors come with a range of benefits to make borrowing easier and more convenient. Here are some key features that make these loans a great choice for medical professionals:

Attractive

Interest Rate

The interest rate on a doctor's Personal Loan is based on their medical profile and income, ensuring the loan remains manageable and not burdensome.

Stress-Free

from Collaterals

A Personal Loan is unsecured, requiring no collateral, which speeds up the approval process. This applies to Personal Loans for doctors as well.

Personalised

Loan Management

Instant loan apps allow doctors to quickly manage loan applications, documentation, and check loan status without disrupting their busy schedule.

Ease

of Documentation

Personal Loans for doctors no longer require photocopies of documents. The applicants just need to provide their KYC details and proof of income.

Automated

EMI Deduction

Once a doctor's Personal Loan is approved, EMIs will be automatically debited, ensuring timely payments without the need to remember the due date.

How to Apply for a Personal Loan for Doctor?

Before you begin, it’s helpful to understand the process and have your details ready. Here are the easy steps to apply for a professional loan for doctors.

Visit the Hero FinCorp website or download the personal loan app.

Next, click the 'Apply Now' button on the personal loan for doctors page.

Fill in your mobile number and register yourself using the OTP sent to you.

Enter the loan amount.

Complete your KYC verification and verify your income eligibility.

Click 'Submit' to complete your online application and get your loan instantly approved.

The latest news.

FAQs.

You can get a Personal Loan for doctors easily through Hero FinCorp’s instant loan app or website. Simply check your eligibility, verify your KYC details, and apply online without visiting a branch.

At Hero FinCorp, doctors can avail a Personal Loan of up to Rs 5 Lakh, subject to meeting the required eligibility criteria.

The interest rate for a Personal Loan for doctors depends on factors like credit score and DTI ratio. At Hero FinCorp, rates start from 1.58% per month.

Yes, doctors can get loans for both personal and professional reasons. A loan for doctors can be taken to improve the quality of medical treatments, expand the clinic, or to meet personal financial goals of further studies, travel, renovation, etc.

The required documents may vary based on whether the doctor is salaried or self-employed. Generally, KYC details and income proof are necessary.

You can apply online through the Hero FinCorp website or loan app and get approval within minutes. Once approved, the loan amount is quickly disbursed to your account.

Personal Loan eligibility for doctors depends on income, credit score, repayment capacity, and employment type—salaried or self-employed.

An MBBS doctor can avail a Personal Loan of up to Rs 5 Lakh, depending on their income, credit score, and repayment capacity.