Personal Loan for Businessman.

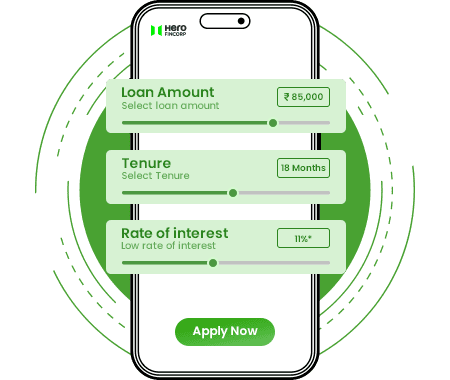

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get Personal Loan For Businessmen Up to 5 Lakh.

Continuous flow of cash is a must when you are running a business. But, there could be situations when you need instant cash for managing your operations or achieving growth. In these scenarios, you can always take a Personal Loan for Businessmen through Hero FinCorp. With just Rs 15,000 monthly income, you can get a loan for up to Rs 5 Lakh. We offer loans with attractive interest rates starting from 1.58% per month and loan tenures from 12 months to a maximum of 3 years. The best part is that when you apply through our website or app, you get approval in less than 10 minutes!

Features and Benefits of a Personal Loan for Businessmen.

Before you apply for a Personal Loan, you must check out the features and benefits of these loans. Here are the key advantages and features of Hero FinCorp’s Personal Loan for businessmen.

Flexible

Tenure

Choose a repayment tenure between 12 to 36 months based on your affordability

Higher

Loan Amount

Get up to Rs 5 Lakh to manage business needs or unexpected expenses.

Unsecured

Loan

Access funds easily without pledging assets or providing collateral.

Easy

Documentation

Submit basic KYC details and income proof for quick loan approval.

Are You Eligible?

Let's Find Out.

To apply for a Personal Loan for Businessmen, make sure you meet the eligibility requirements, including your age, monthly income, work experience, and citizenship. At Hero FinCorp, the personal loan eligibility criteria are simple and easy to fulfil.

- •Age: You must be between 21 to 58 years.

- •Citizenship: You should be a citizen of India.

- •Work Experience: Your business must be at least two years old.

- •Monthly Income: The minimum monthly income required is Rs 15,000.

Interest Rates on Personal Loans for businessmen.

It’s better to know the loan costs, like the interest rates and processing fees, before applying for a Personal Loan for Businessmen. At Hero FinCorp, personal loan interest rates are competitive, and other charges are nominal. Check out the details.

Interest

Rate

Starting from 1.58% per month

Loan

Processing Charges

Minimum Processing fee is 2.5%+ GST

Prepayment

Charges

N.A.

Foreclosure

Charges

5% + GST

EMI

Bounce Charges

Rs 350/-

Interest

on Overdue EMIs

1-2% of the loan/EMI Overdue Amount Per Month

Cheque

Bounce

Fixed Nominal Penalty

Loan

Cancellation

1. Online loan app does not charge any cancellation charges

2. Interest amount paid is non-refundable

3. Processing charges are also non-refundable

How to Apply for a Personal Loan for Businessmen?

As a business owner with limited free time, you may not always be able to physically visit the lender's branch and apply for loans. At Hero FinCorp, you can apply for a Personal Loan for businessmen online. Here are the steps to follow:

Visit the Hero FinCorp website or install the personal loan app

Go to the personal loan page and click ‘Apply Now’

Enter your mobile number and verify with the OTP received

Choose the loan amount you need

Verify your KYC details to check income eligibility

Click ‘Submit’ to complete your application

What do people think about Hero FinCorp.

Kadam Kailash -

Lalji Soni -

Raj Chaudhary -

The latest news.

FAQs.

Yes, you can pre-close your Personal Loan by paying the outstanding amount before the tenure completion. Pre-closure may involve a nominal fee as per the loan agreement.

Yes, you may get rejected for a loan even with a good income due to your poor credit score, lender policies, loan defaults or incomplete documents.

You can get approval for a Personal Loan in less than 10 minutes by applying on the Hero FinCorp website or loan app.

No, most lenders provide unsecured personal loans. However, if you fail to demonstrate your repayment capacity, the lender may require you to put up any valuable asset as collateral or to add a co-applicant with a strong credit profile for approving funds.

You may apply for a Personal Loan for emergencies, expansion of your business, medical needs, or any other need requiring additional financing.

Yes, business owners can take Personal Loans with minimal documentation and flexible terms depending on their preferences, needs, and personal finances.

No, Personal Loans and business loans are different. Personal loans are unsecured and available to salaried or self-employed professionals, while business loans are intended only for business needs.

A Personal Loan for business can be utlised for all business needs. Applications can be made online easily with basic documentation on the Hero FinCorp website or app.

You must be a citizen of India between the ages of 21 and 58 years, having an income of Rs 15,000 or more, and a minimum work experience of 2 years.

Yes, you can use a Personal Loan to grow or expand your small business. Personal loans are unsecured loans so you can use the loan amount for any business purpose.

A business owner can apply for a Personal Loan for a maximum of up to Rs 5 lakh from Hero FinCorp, subject to needs and eligibility.

Interest rate can vary depending on credit profile, debt-to-income or DTI ratio and lender policies. Hero FinCorp’s Personal Loan interest rates start at 1.58% per month.

Yes, a self-employed person or an entrepreneur can easily apply for a Personal Loan with minimal documents and proof of income (at least Rs 15,000 per month).

Yes, there is no collateral or guarantor required for a Personal Loan for business with Hero FinCorp as Personal Loans are unsecured.