Loan Against Property In Karnal.

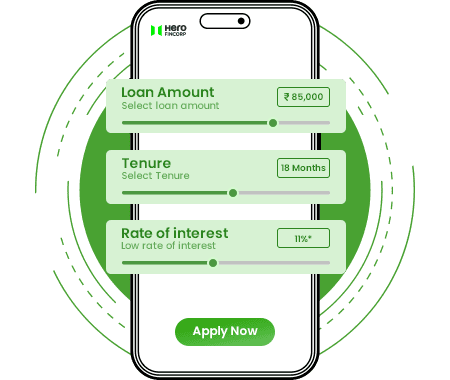

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get a Loan Against Property in Karnal Upto 5 Crore.

Karnal, a city in the heart of Haryana, seamlessly blends tradition and modernity. It has a rich historical heritage, with ancient landmarks such as the Karna Lake and the Miran Sahib's Tomb from the Mughal era, offering a glimpse into India's past.

The city is also a significant player in the country's agricultural sector, home to the National Dairy Research Institute (NDRI) and Maharana Pratap Horticultural University. Being located on National Highway-44 and having robust rail connectivity makes Karnal an important commercial hub.

Karnal has a rich culture and varied cuisines. It is also a great place to invest in a dream home or start a business. If you're facing financial roadblocks or any sudden financial urgency, getting a Mortgage Loan in Karnal from Hero FinCorp could be a smart choice. We offer up to Rs. 5 Crore with flexible tenure of up to 15 years to help you overcome any financial shortage.

Features And Benefits of Loan Against Property in Karnal.

Know the features and benefits of getting a Loan Against Property in Karnal:

High

Loan Amount

Use your property as collateral to secure a loan up to Rs 5 crore from Hero FinCorp.

Attractive Interest Rate

Benefit from low interest rates, reducing monthly payments and overall borrowing costs.

Quick

Loan Procedure

Just apply online with complete documentation and get quick access to the necessary funds.

Easy

Repayment & Longer Tenure

Our Mortgage Loans offer flexible repayment options with terms up to 180 months.

Higher

LTV

Borrow up to 175% of your property's value, maximizing your borrowing potential.

Hassle-free Documentation

The documentation process is simple and hassle-free, with no tedious paperwork.

Are You Eligible?

Let's Find Out.

To acquire a Mortgage Loan in Karnal, you must meet specific requirements. Here's what you need to know for eligibility:

- •Age: You must be between 25 and 75 years of age bracket.

- •Citizenship: You must be a citizen of India.

- •Work Experience: At least 3 years of work experience is needed.

- •Business Status: Business stability of 3 years is considered.

- •Occupation Status: The applicant should be self-employed or an entrepreneur running a profitable business.

Interest Rates and Charges for Loan Against Property in Karnal.

Curious about the interest rates? Hero FinCorp offers the lowest Mortgage Loan interest rates in Karnal, starting at 11%. However, the interest rate you are offered is based on your income, occupation status, and property condition. You can choose between two types of interest rates: fixed or floating. Your monthly payments will remain unchanged if you choose a fixed interest rate. However, your EMIs may vary based on market conditions if you opt for a floating interest rate.

Maximum

Loan Amount

₹20 Lakh to ₹ 5 Cr

Maximum

Loan Tenure

3 Years (Min.) – 15 Years (Max)

Interest

Rate

Starting from 11% P.A.

Processing

Fees

Minimum Processing fee is 1%+ GST

Foreclosure

Charges

Pre-Payment is not allowed within 12 months of loan sanction After 12 months, pre-payment charges will be applicable as described in the sanction letter

How To Apply For a Loan Against Property in Karnal?

To apply for a Loan Against Property in Karnal through Hero FinCorp, follow these straightforward steps:

Visit Hero FinCorp website and go to the loan against property page.

Check your eligibility from the eligibility criteria section available on the website.

On the mortgage loan page, check for the mandatory documents required for a mortgage loan.

Click the 'Apply now' tab and fill in the required information, and submit the online form.

Once Hero FinCorp is satisfied with your details, their executives will get in touch with you.

You may also apply for a mortgage loan by visiting the nearest Hero FinCorp branch or outlet.

FAQs.

Typical mortgage loan application info includes income, credit history, property details, and employment status.

Lowering debt and increasing income can improve the DTI ratio for mortgage qualification.

Tax benefits apply to some online mortgage loans, consult a tax advisor.

Yes, you can use a LAP for business purposes, subject to lender approval.