Loan Against Property In Coimbatore.

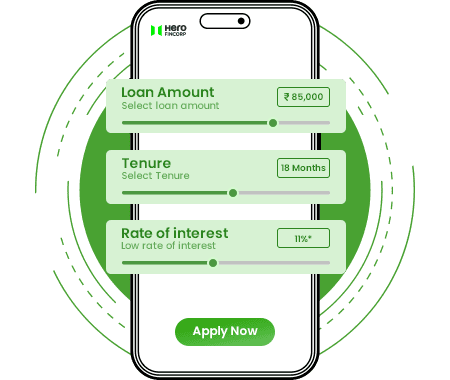

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get a Loan Against Property in Coimbatore Upto 3 Crore.

Coimbatore, a city in Tamil Nadu, is most famous for its Marudhamalai Hill Temple and the Dhyanalinga Temple, which offer visitors a chance to experience a peaceful atmosphere. It is also referred to as the "Manchester of South India" because of its flourishing textile industry and the presence of esteemed engineering companies like Pricol and L&T.

The city is located in the midst of the gorgeous Velliangiri Mountains, which provide a lush green landscape and a pleasant climate throughout the year, making it a great place to call home. Also, it is a city of excellent educational institutions, making it a popular choice for people looking for quality education. In addition to this, it is a great place to live.

Whether you're a first-time homebuyer or an experienced investor, obtaining a mortgage loan in Coimbatore is a smart decision that guarantees you're not just buying a house but investing in a bright future in a city with so much to offer. With our mortgage loans, you can avail a substantial amount of Rs. 3 Crore with instant approval and an LTV ratio of 175%.

Features And Benefits of Loan Against Property in Coimbatore.

Here are the features and benefits of getting a mortgage loan in Coimbatore:

High

Loan Amount

You can use your property for a bigger loan, helping you reach your financial goals.

Attractive Interest Rate

Enjoy the advantage of paying less interest, which means smaller monthly payments and overall loan costs.

Quick

Loan Procedure

Applying for a loan is pretty easy, and you'll quickly get the money you need.

Easy

Repayment & Longer Tenure

You can repay the loan, and the repayment period is longer, making it easier to manage.

Higher

LTV

You can borrow up to 175% of your property's appraised value and type, giving you more borrowing power.

Hassle-free Documentation

The paperwork is straightforward and hassle-free, so you won't have to deal with complicated forms.

Are You Eligible?

Let's Find Out.

You must meet certain conditions to get a Loan Against Property in Coimbatore. Here's what you should be aware of to see if you are eligible for property loan:

- •Age: You need to be in the age range of 25 to 75 years old.

- •Citizenship: You must be an Indian citizen.

- •Work Experience: You must have worked for at least 3 years.

- •Business Status: Business stability of 3 years is taken into consideration.

- •Occupation Status: You should have a successful business. This loan is not for salaried people.

Interest Rates and Charges for Loan Against Property in Coimbatore.

If you're thinking about getting a mortgage loan in Coimbatore from Hero FinCorp in Coimbatore, it's essential to understand the loan against property interest rates. These competitive rates depend on your income, job, and property condition. You can pick between fixed or floating rates. Fixed rates mean your monthly payment stays the same while floating rates can change. To determine how much you can borrow, use our online interest rate calculator and decide what's best for you.

Maximum

Loan Amount

₹20 Lakh to ₹ 3 Cr

Maximum

Loan Tenure

3 Years (Min.) – 15 Years (Max)

Interest

Rate

Starting from 11% P.A.

Processing

Fees

Minimum Processing fee is 1%+ GST

Foreclosure

Charges

Pre-Payment is not allowed within 12 months of loan sanction After 12 months, pre-payment charges will be applicable as described in the sanction letter

How To Apply For a Loan Against Property in Coimbatore?

To apply for a Loan Against Property (LAP) in Coimbatore through Hero FinCorp, follow these straightforward steps:

Visit Hero FinCorp website and go to the loan against property page.

Check your eligibility from the eligibility criteria section available on the website.

On the mortgage loan page, check for the mandatory documents required for a mortgage loan.

Click the 'Apply now' tab and fill in the required information, and submit the online form.

Once Hero FinCorp is satisfied with your details, their executives will get in touch with you.

You may also apply for a mortgage loan by visiting the nearest Hero FinCorp branch or outlet.

FAQs.

Hero FinCorp accepts almost all properties, such as land, buildings, apartments, factories, shops, hospitals, schools, and more.

Generally, processing the loan in Coimbatore takes a few days to a week.

Yes, transferring your existing Loan Against Property to another bank is possible.

Hero FinCorp doesn’t offer LAP for agricultural land in Coimbatore.

A good credit score is essential for a mortgage loan to avail of a better interest rate.