Loan Against Property in Jaipur.

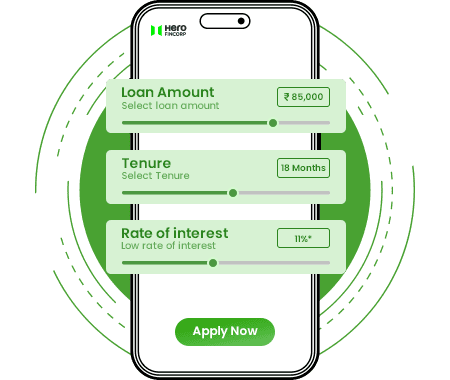

Calculate Your EMI

Estimate your monthly outflow and adjust your tenure with ease using our EMI Calculator. Plan confidently and borrow smartly.

Get a Loan Against Property in Jaipur Upto 5 Crore.

Jaipur, also known as the Pink City of India, is a destination steeped in fascinating history and rich culture. It boasts many amazing places to explore, including the grand Amer Fort, delicate Hawa Mahal (Palace of Winds), and majestic City Palace.

Jaipur is renowned for producing beautiful jewelry and traditional textiles like handcrafted fabrics and block printing, which are widely appreciated worldwide. Alongside, the city is known for its delicious food and colorful markets.

Moreover, Jaipur's cultural heritage, economic opportunities, and the desire for a comfortable lifestyle attract people to invest and enjoy a better life. If you own a property in Jaipur, you have a basket full of opportunities. Mortgage Loans in Jaipur cater to the diverse aspirations of its residents. Hero FinCorp offers you a sum as high as Rs. 5 Crores, a 175 % LTV Ratio, and quick approval.

Features And Benefits of Loan Against Property in Jaipur.

Private Mortgage Loan in Jaipur with Hero FinCorp brings several benefits, such as a large loan amount, competitive interest rates, a fast application process, increased borrowing capacity, and streamlined paperwork. Keep reading to learn how these advantages can work together to help you reach your financial goals effortlessly.

High

Loan Amount

Use your property to secure a higher loan and achieve your goals.

Attractive Interest Rate

Paying less interest saves you money, leading to affordable payments and costs.

Quick

Loan Procedure

You can easily apply for a loan and have the funds you require within minutes.

Easy

Repayment & Longer Tenure

The loan offers flexible repayment options and a longer repayment duration.

Higher

LTV

You can access greater funds with a loan up to 175% of your property's value.

Hassle-free Documentation

You will not struggle with challenging forms as the paperwork is elementary and straightforward.

Are You Eligible?

Let's Find Out.

If you want to get a Loan Against Property in Jaipur, there are specific requirements that you must meet. You can determine if you meet these requirements by examining the following information:

- •Age: You have to be between the ages of 25 and 75.

- •Citizenship: You must be a citizen of India.

- •Work Experience: You must have been employed for at least three years.

- •Business Status: Three years of business stability are taken into account.

- •Occupation Status: You should have a stable business. Salaried individuals are not eligible.

Interest Rates and Charges for Loan Against Property in Jaipur.

Before taking out a mortgage loan from Hero FinCorp, it's important to have an idea of the interest rates. Hero FinCorp’s mortgage loan interest rates in Jaipur are reasonable and are based on factors such as your profession, earnings, and the condition of your house.

To help you make the best decision, we offer an online interest rate calculator that can assist you in determining the amount you are eligible to borrow and choosing the most suitable option.

Maximum

Loan Amount

₹20 Lakh to ₹ 5 Cr

Maximum

Loan Tenure

3 Years (Min.) – 15 Years (Max)

Interest

Rate

Starting from 11% P.A.

Processing

Fees

Minimum Processing fee is 1%+ GST

Foreclosure

Charges

Pre-Payment is not allowed within 12 months of loan sanction After 12 months, pre-payment charges will be applicable as described in the sanction letter

How To Apply For a Loan Against Property in Jaipur?

If you have made up your mind already to apply for a Loan Against Property (LAP) in Jaipur through Hero FinCorp, follow these simple steps:

Visit Hero FinCorp website and go to the loan against property page.

Check your eligibility from the eligibility criteria section available on the website.

On the mortgage loan page, check for the mandatory documents required for a mortgage loan.

Click the 'Apply now' tab and fill in the required information, and submit the online form.

Once Hero FinCorp is satisfied with your details, their executives will get in touch with you.

You may also apply for a mortgage loan by visiting the nearest Hero FinCorp branch or outlet.

FAQs.

Buying mortgage flats can be a sound investment if you consider location, property value, and your financial situation.

A low CIBIL score is not ideal for a mortgage loan application.

Yes, you can obtain a mortgage loan for land, typically for construction or development purposes.