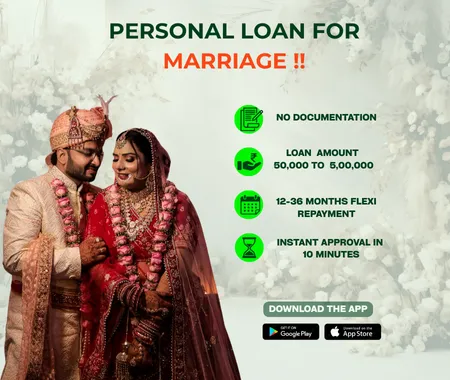

Personal Loan for Marriage.

Get Approval for Marriage Loan in 10 Minutes.

Indian families start saving money early for their children’s marriage. However, wedding expenses often exceed the budget, forcing individuals to compromise on their dreams. You don't need to worry about that, as a loan for marriage is available from Hero FinCorp to cover you financially. With a marriage loan amount of Rs 50,000 to Rs 5 Lakh, you can cover unexpected expenses without stressing your finances.

At Hero FinCorp, you may obtain a Personal Loan for marriage at competitive interest rates starting at 19% per annum. Choose a tenure of 12 to 36 months to repay the loan in easy EMIs.

How to Apply for Marriage Loan Online Through Hero FinCorp.

Here is how you can apply for a Personal Loan for marriage through Hero FinCorp:

Visit the Hero FinCorp website.

In the instant personal loan section, click 'apply now'.

Enter your desired loan amount, tenure, and set your EMI.

Complete the KYC document verification.

After verification, the loan amount is disbursed within 24 hours.

The latest news.

FAQs.

The paperless documentation and real time verification of loan application online has reduced the sanction period for marriage loan.

A minimum starting income of Rs.15,000 is valid to apply for marriage personal loan

Being an Indian citizen, holding a stable profession, earning at least 15000 rupees per month and submitting the mandatory documents are the basic requirements of acquiring a marriage loan

This depends from lender to lender. Pre-payment of marriage loan or early payment of loan EMIs is often followed by a penalty for the borrowers. Hence, do read about the prepayment policies before initiating it.