Instant Personal Loan App.

Need funds urgently? Download the fastest loan App to apply for a Personal Loan up to Rs 5 Lakh and get the financial support you need quickly and securely.

Get Quick Personal Loan Approval with Hero FinCorp App.

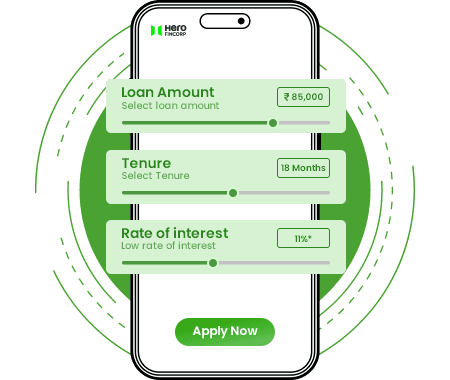

The mobile-first application process makes borrowing money accessible, quick, and easy. You can apply online, get instant approval, and access funds right when you need them. Borrow anywhere between Rs 50,000 and Rs 5 Lakh without any collateral.

The personal loan app is simple to use, and the easy step-by-step process ensures fast approval and quick disbursement. You can choose flexible repayment options from 12 to 36 months, with interest rates starting at 19% per annum.

Whether it is for a wedding, education, home repairs, or a sudden trip, Hero FinCorp is a trusted financial partner for instant loan needs in India. Download the instant loan app to avail loan in minutes.

Features & Benefits.

Hero FinCorp brings the best of user-friendly features and benefits to simplify urgent financial needs. As a regulated NBFC, we ensure a transparent and efficient borrowing experience.

- 100% Digital Process: No physical documents are required during registration. Verification is done using the KYC details submitted online.

- No-Collateral Loan: Personal Loan requires no security or guarantor. Individuals who meet the eligibility criteria are given quick loans.

- Small Cash Loan: Satisfy your urgent financial needs with instant Personal Loan ranging from Rs 50,000 to Rs 5 Lakh.

- Quick Disbursal: Once your details are verified, the loan is approved within minutes, and the amount is credited to your bank account.

- No Hidden Charges: We follow a transparent process with no hidden charges at any stage of the Personal Loan journey.

- User-friendly Interface: New users registering with Personal Loan app find it easy to navigate through each step. It ensures the registration process is completed correctly.

Personal Loan Solutions Tailored to Your Needs.

The mobile App makes borrowing quick, easy, and paperless for everyone, whether you’re salaried or self-employed. With instant approval and a secure digital process, it’s one of the best quick loan apps in India.

For

Salaried Professionals

Salaried individuals can use the instant loan app for salaried professionals to cover unexpected expenses such as medical bills, rent, or travel plans. The process is completely online, and once approved, the funds are credited directly to your account.

For

Self-Employed Individuals

Freelancers, entrepreneurs, and small business owners can rely on the mobile app to maintain a steady cash flow. It helps manage business costs, buy equipment, or handle slow months. Flexible EMIs and quick disbursal make it a reliable instant loan app for self-employed individuals who value convenience and control.

For

Students

The instant loan app for students makes it easy to cover education and personal expenses. Whether you need to pay tuition fees, buy study materials, or plan an education trip, this education loan app offers quick funds without requiring a guarantor or collateral. The simple online process saves time and effort, making it perfect for students.

For

Emergencies

In urgent situations, such as medical needs or sudden travel, emergency loan apps provide fast access to funds. With an entirely paperless process and instant approval, it ensures you are financially ready when unexpected expenses arise.

For

Travel and Personal Plans

If you are planning a trip or fulfilling a personal dream, you can take a loan with the travel loan app. You can use the loan to book flights, hotels, and activities without worrying about finances. You can borrow up to Rs 5 lakh and repay easily in flexible EMIs.

Small

Loan

If you ever find yourself short on funds before payday or need to handle an unexpected expense, a small loan app can be a real lifesaver. With fast approvals, it takes the stress out of handling short-term money issues and helps you stay on track financially.

Short-Term

Loan

A short-term loan app is best for those who need funds for a limited period and prefer faster repayment. It’s designed to give you flexibility without long commitments. You can repay it within months and stay financially stress-free.

Quick

Loan

A quick loan app gives you instant access to money when you need it the most. Whether it’s an emergency or a sudden expense, the process is fast and simple. Apply online and get funds credited in no time.

Cash

Loan

A cash loan app provides direct financial help when you need liquid cash urgently. It helps handle daily expenses or emergencies. You can apply online and receive the money straight into your account without delays.

Mobile

Loan

A mobile loan app lets you apply, track, and manage your loan directly from your phone. It’s a convenient and secure way to get funds anytime, anywhere. With just a few taps, you can complete the process without visiting a branch.

How to Apply for a Loan Online via Instant Personal Loan App?

We offer instant Personal Loans of up to Rs 5 lakh through a simple, 100% digital mobile app process. You can get quick approvals and easy access to funds right from your phone.

Here is how it works:

Install the app: Download the app from the Play Store.

Select loan details: Choose your desired loan amount (up to Rs 5 lakh) and preferred EMI plan.

Provide basic information: Enter your Name, Income, Loan Purpose, and PAN Card number.

Complete KYC: Verify your identity by completing the KYC process.

Enter bank details: Input your bank account details for loan disbursement.

Get approval: Receive real-time loan approval.

Sign digitally: Digitally sign the e-Mandate and loan agreement.

Receive funds: The approved loan amount will be credited directly to your bank account.

The latest news.

FAQs.

A loan app is a mobile app that lets you apply for a Personal Loan online, receive instant approval, and get a quick disbursement without visiting any office.

You can download the online Loan App, complete KYC, verify your bank, choose your amount, e-sign, and get instant approval.

To get a Personal Loan at a low-interest rate through an app, maintain a good credit score, choose the right tenure, avoid multiple applications, and repay existing debts to show financial stability and reduce your debt-to-income ratio.

Online Personal Loan apps are safe when properly verified. Always cross-check details on the official website, read user reviews on the Google Play Store or Apple App Store, and look for consistent information. Avoid apps that ask for unnecessary permissions, personal data, or upfront fees.

Disclaimer.

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.