What Is Debt Management? Meaning and Plan Explained

Multiple credit cards and a couple of small personal loans to fund one's lifestyle and medical emergencies have become commonplace.

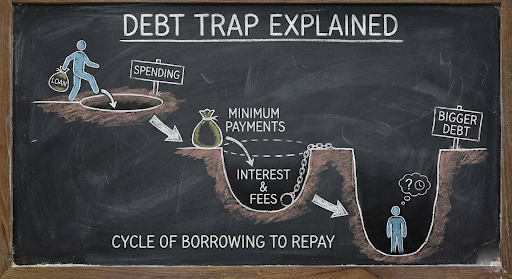

One can be found juggling different EMI dates and high-interest rates, leaving them with almost no savings at the end of the month. This is what we call being in a "debt trap." To break free, one needs to understand what debt management is.

In essence, effective debt handling isn't just about paying off what you owe but also about strategically organizing your finances to regain control.

What Is Debt Management?

Debt management refers to a systematic approach to controlling and reducing your outstanding liabilities. Debt management is like being the coach of your own money. You look at all your debts (the players), create a smart playbook (your budget) to tackle them one by one, and make sure you don’t run your main account (yourself) so ragged that you can’t function day-to-day. It turns a scary mess into a winnable game.

Key components include:

- Budgeting: Tracking income versus expenses.

- Prioritization: Identifying high-interest debts (like credit cards) to pay off first.

- Negotiation: Communicating with lenders for better terms.

Key Principles of Effective Debt Management

To make your debt management strategy easy to follow, here is a breakdown of the core components and principles:

| Budgeting | Tracking every rupee of income versus your monthly expenses. | It gives you a clear picture of how much "extra" cash you actually have. |

| Prioritization | Identifying high-interest debts, like credit cards, to pay off first. | It stops expensive interest from snowballing and saves you money. |

| Negotiation | Communicating with lenders to ask for lower rates or better terms. | It can reduce your total debt burden without needing extra cash. |

| Consistency | Making every single payment on time, every time. | It protects your CIBIL score and helps you avoid heavy late fees. |

| Cost Reduction | Cutting back on non-essential spending (like dining out). | It frees up more money to redirect toward clearing your loans faster. |

Understanding a Debt Management Plan (DMP): Meaning and Process

Think of a debt management plan like this:

- You work with a nonprofit credit counselor.

- They talk to all the companies you owe (credit cards, etc.) and negotiate on your behalf.

- You agree to a new, affordable monthly payment plan, often with lower interest.

- Instead of paying each company separately, you send one single payment to the counseling agency each month.

- The agency distributes that money to all your creditors, simplifying everything for you.

Role of Credit Counseling Agencies in DMPs

Think of a credit counseling agency as a professional middleman. Instead of you feeling overwhelmed while dealing with banks alone, these experts step in to handle the difficult conversations for you.

Through their debt counseling services, they first help you get a crystal-clear view of your financial health. Then, they contact your lenders to negotiate on your behalf. Their goal is to convince banks to lower your interest rates or waive penalties, ultimately creating a customized payment plan that actually fits your monthly take-home pay.

The Step-by-Step Debt Management Process

- Financial Assessment: Analyzing all income, assets, and liabilities.

- Counseling: Working with an expert to draft a realistic budget.

- Proposal: The agency sends a debt management plan proposal to your creditors.

- Consolidation: You make one monthly payment to the agency, which then distributes it to your lenders.

Impact of Debt Management on Your Credit Score in India

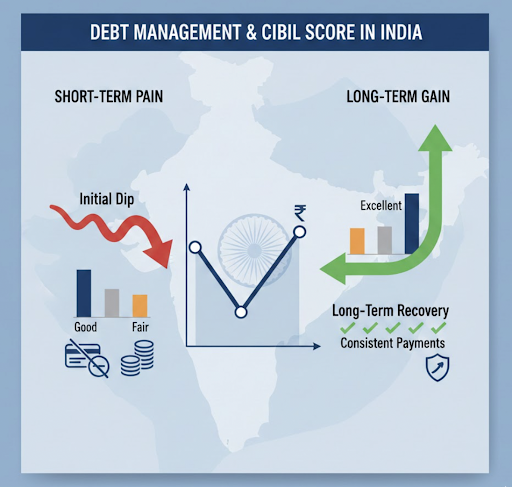

In India, your CIBIL score is your financial identity. Many wonder about the debt management credit score connection. While a DMP helps you pay off debt, the journey can be a bit of a rollercoaster for your credit profile.

Initial Credit Score Fluctuations with a DMP

When you start a DMP, you might see a credit score dip. This happens because you may be asked to close credit card accounts, which reduces your total available credit limit and affects your credit utilization ratio. This short-term credit impact is common but usually temporary.

Long-Term Benefits for Credit Health

In the end, this is about long-term credit recovery. Making every single payment on the plan does two key things: it lowers your overall debt, and it creates a positive track record of reliable payments. Lenders see this, and that's what improves your credit score and helps it go back up.

Pros and Cons of a Debt Management Plan (DMP)

Here's a quick breakdown of the pros and cons of a debt management plans:

| Pros | Cons |

| Single Monthly Payment: Simplifies your finances. | Account Closure: Requires closing credit cards. |

| Lower Interest Rates: Agencies often negotiate better terms. | Credit Impact: Initial dip in your CIBIL score. |

| Stop Collection Calls: Creditors usually stop harassing you. | Time Commitment: Usually takes 3 to 5 years. |

Debt Management vs. Debt Consolidation: An HeroFincorp Guide

While they sound similar, there is a key difference between DMP and consolidation. A DMP is a repayment schedule managed by a counselor. Debt consolidation involves taking a new loan to pay off all existing ones.

When a Personal Loan from HeroFincorp for Debt Consolidation is Ideal

A personal loan for debt consolidation is a powerful HeroFincorp debt solution.

If you have a decent credit score but are struggling with high-interest credit card debt (which can charge up to 40% annually), taking a HeroFincorp Personal Loan at a much lower interest rate to pay them off is often the smarter move. It streamlines your debt into one EMI without the need for a third-party agency.

HeroFincorp Alternatives for Effective Debt Management

If a formal DMP feels too restrictive, there are other debt management solutions. You can opt for balance transfers or asset-backed loans. However, the most popular choice remains HeroFincorp personal loans for their speed and transparency.

Exploring HeroFincorp Personal Loans for Debt Streamlining

With a HeroFincorp personal loan, you can consolidate debt quickly through a digital application process. This allows you to pay off multiple small, high-cost vendors and deal with only one lender, making your financial life significantly simpler.

Short on funds? Download our instant loan app and apply for a quick loan in minutes.

Choosing Your Best Debt Management Strategy with HeroFincorp

Choosing the best debt management strategy starts with understanding your financial situation and aligning it with a solution that offers clarity, flexibility, and long-term stability. Whether you are overwhelmed by multiple EMIs or looking for a smarter way to reduce high-interest debt, the right approach can make a significant difference.

With a strong focus on financial planning, HeroFincorp borrowers can explore options that simplify repayments without adding unnecessary complexity. From debt consolidation through personal loans to structured repayment support, HeroFincorp helps you move from short-term relief to long-term financial discipline.

Frequently Asked Questions

What types of debt can be included in a DMP?

DMPs are mainly for unsecured debts like credit card balances and personal loans. Secured loans, such as home or car loans, generally cannot be included because they are backed by assets.

How long does a typical debt management plan take to complete?

Most plans are structured to make you debt-free within 3 to 5 years, depending on your total debt amount and your monthly repayment capacity.

Will a debt management plan stop collection calls from creditors?

Yes. Once your lenders agree to the plan and you begin making regular payments through the agency, those stressful collection calls and letters usually stop.

Are there any upfront fees for enrolling in a debt management plan?

Most credit counseling agencies charge a small setup fee and a nominal monthly maintenance fee to manage the negotiations and payments for you.

How does HeroFincorp assess my eligibility for a consolidation loan?

We look at simple factors: your monthly income, age, employment stability, and your current credit history to ensure the loan is a comfortable fit for you.

Can I still use my credit cards if I'm on a debt management plan?

Usually, no. To help you break the cycle of debt, most plans require you to stop using and close your credit card accounts until the plan is fully completed.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.