NEFT vs. RTGS vs. IMPS vs. UPI: Key Differences

Amit was new to net banking and wanted to send some money on his phone. When he opened the app, four payment options appeared: NEFT, RTGS, IMPS, and UPI. Although he had seen these options before, he never really thought about what made them different.

Many people might get confused seeing these options. Payments feel simple until too many choices appear on the screen. Without knowing which option fits which situation, people guess and move ahead. Understanding this makes everyday payments feel lighter and more controlled.

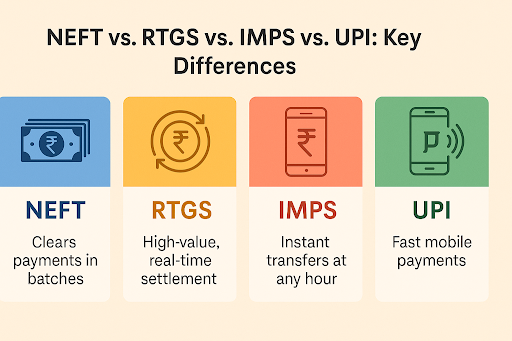

What Are IMPS, NEFT, RTGS, and UPI?

IMPS, NEFT, RTGS, and UPI are four common ways people send money through banks in India. Banks offer these options because not every payment needs the same speed or timing. Some payments must reach immediately, while others can wait for a few hours without any issue.

IMPS is used when money must reach the other person right away. It works at all hours and suits urgent payments, such as paying a vendor or sending money in an emergency.

NEFT is meant for regular payments that do not need instant delivery. The bank processes these payments in scheduled cycles, which makes it suitable for rent, school fees, or planned transfers.

RTGS is used for large amounts that require immediate confirmation. It works during bank hours and is commonly chosen for high-value payments where delay is not acceptable.

UPI is designed for daily mobile payments. People use it to pay for food, shopping, or small transfers because it is quick, simple, and works at any time of the day.

Comparison Table: IMPS vs NEFT vs RTGS vs UPI

When you reach the payment screen, all four options appear together. That is usually when confusion starts, because the names look familiar, but the outcome can be very different. This table lays out the practical differences clearly, so you know what will happen before you tap confirm.

| Feature | IMPS | NEFT | RTGS | UPI |

|---|---|---|---|---|

| Speed | Instant | Batch-settled | Real-time | Instant |

| Availability | 24\7 | All days | Banking hours | 24/7 |

| Limits | Bank dependent | No maximum | Minimum two lakh | Up to one lakh |

| Charges | Bank specific | Mostly zero | Bank specific | Zero for users |

This table shows which method suits urgent payments, high-value needs, or mobile transfers. It also helps you understand how banks manage each system and why choosing the right mode improves your payment experience.

Key Differences Between IMPS, NEFT, RTGS, and UPI

This is the point where most people feel unsure after sending money and start checking their phone again and again. The reason is simple: each payment option works differently once the transfer is started.

Transaction Speed and Availability

Speed affects how users choose transfer systems.

- IMPS offers instant transfers at any time.

- UPI also allows instant payments round-the-clock, including holidays.

- NEFT uses half-hour batches throughout the day.

- RTGS processes high-value transfers in real time but only during banking hours.

Quick chart:

- NEFT: Batch, all days

- RTGS: Real-time, business hours

- IMPS: Instant, 24/7

- UPI: Instant, 24/7

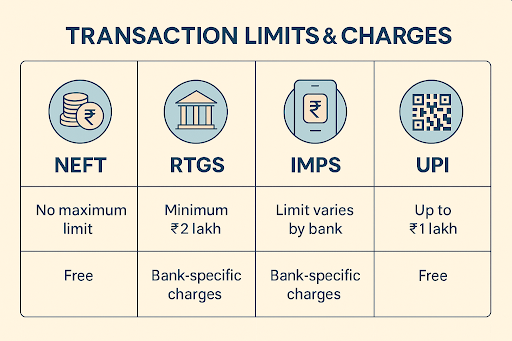

Transaction Limits & Charges

Transaction limits vary across systems.

- NEFT has no maximum limit for transfers.

- RTGS requires a minimum of two lakh per transaction.

- IMPS limits differ by bank and depend on individual account policies.

- UPI supports up to Rs 1 lakh for most users and suits daily mobile payments.

Charges also differ across banks.

- NEFT is usually free for most bank transfers.

- RTGS and IMPS may include bank-specific fees, depending on the bank and transfer amount.

- UPI is free for everyday personal payments like transfers between individuals and regular bill payments.

Security and Refund Policies

All four systems follow RBI-regulated safety measures.

- NEFT and RTGS operate on secure bank-controlled networks that follow strict verification steps.

- IMPS and UPI use multi-factor authentication to protect users.

Refund timelines differ.

- NEFT and RTGS refunds follow structured procedures defined by each bank.

- IMPS refunds arrive within standard bank timelines.

- UPI refunds return quickly for failed payments.

Choose the Right Payment Method for Your Needs

Each payment method has its own use. IMPS and UPI work well for quick, everyday transfers. NEFT suits planned payments, while RTGS is meant for large amounts that need secure and immediate settlement.

Sometimes, the issue is not the payment method but arranging money on short notice. In such moments, having access to a simple digital loan can help. Hero FinCorp offers an easy online personal loan journey through its personal loan app, making it easier to handle unexpected expenses with confidence.

Frequently Asked Questions

Which is fastest: IMPS, NEFT, RTGS, or UPI?

UPI and IMPS are the fastest because both offer instant transfers at any hour.

Are there any charges for UPI payments?

UPI payments are free for users as per the current NPCI guidelines. This structure encourages secure digital adoption across India.

Can I use RTGS on bank holidays?

RTGS does not operate on bank holidays because it follows banking hours. You must plan high-value transfers during active settlement windows.

What is the maximum transaction limit for NEFT?

There is no maximum limit to transfer from NEFT. You can transfer any amount according to your requirement.

Is IMPS available 24/7?

Yes. Transfers can be made at any time via IMPS, including holidays.

What should I do if my transaction fails, but money is debited?

Most failed payments reverse automatically within the standard timeframe. If the refund does not appear, contact your bank with the transaction reference for further support.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.